Renewable energy may be relatively cheaper to produce. But the investment and logistical retooling required to go cold turkey on coal is substantial to the point of being dangerously impractical. The socioeconomic stability of many countries is contingent on them being allowed to transition to a cleaner energy mix – an abrupt exclusion of fossil fuels would heighten the risk of hardship.

In a parallel vein, investors should not suffer inappropriate portfolio risk through wholesale exclusions in the name of ESG. A more balanced approach is both possible and, critically, sustainable.

Science says we are falling behind in our efforts to keep the global mercury levels from reaching disastrous highs. In that context, it seems logical to berate the transition approach and exalt its more expedient cousin, exclusion. But consider the following evidence from The Economist (12 February):

- Pressed by investors, the six biggest western oil companies have sold $44bn worth of fossil fuel assets since 2018

- Private equity firms have bought $60bn worth of oil, gas, and coal assets in the last two years, roughly 30% more than they’ve invested in renewables

In short, divested ‘dirty’ energy assets are not being shut down. On the contrary, their ownership is being transferred to private operators that are subject to less scrutiny around environmental impact.

One solution to this problem is to engage with public companies around the decommissioning of dirty assets over time. The same collaborative approach should be applied to social and governance issues to avoid knee-jerk reactions that leave the underlying challenges unsolved.

Fear of missing out (FOMO) is a dangerous emotion in the context of investing; it can overwhelm logic and dissolve investment discipline. Portfolios that use wholesale ESG exclusions tend to heighten the risk of investor FOMO. As a recent example, a lack of mining or commodity exposure would have been unsettling.

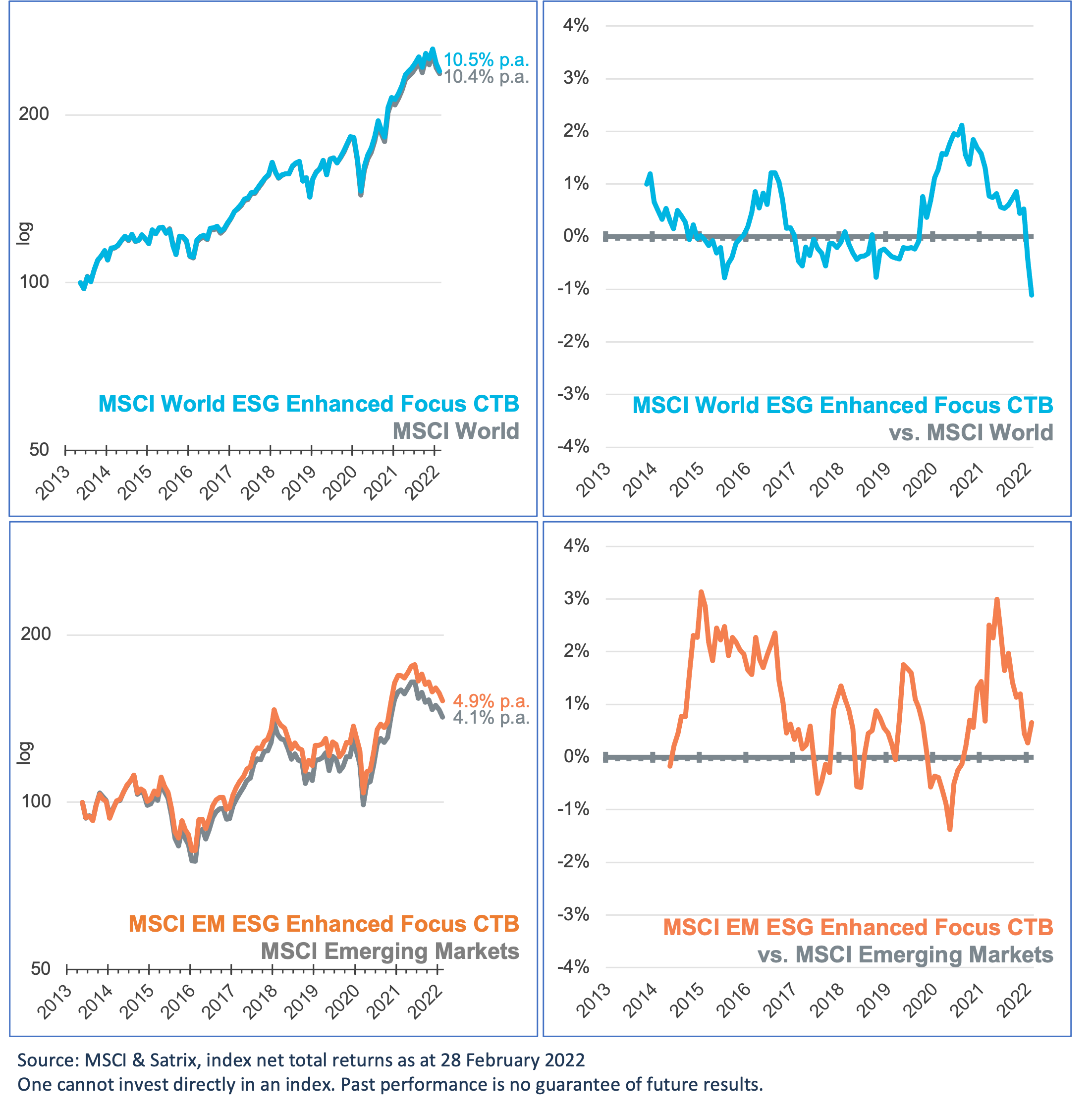

Take the features of the MSCI ESG Enhanced Focus Climate Transition Benchmark (CTB) indices. They are constructed to deliver performance similar to the index on which they are based – MSCI World, for example – while achieving the following additional goals:

- Reduce the GHG intensity of the index by 7% every year

- Generate 30% less GHG emissions than the parent index

- Maximise ESG scores

Cumulative and rolling 12-month relative performance vs. parent index

This valuable equilibrium of return vs. impact is achieved by limiting wholesale exclusions in favour of an index weighting methodology that solves for a variety of objectives, including the mitigation of FOMO. As the third bullet above suggests, environmental issues are but one consideration in their construction.

Like their benchmarks, they are managed to deliver similar performance to their respective market indices – MSCI World and MSCI Emerging Markets – with lower GHG emissions and higher ESG scores at no extra cost when compared to our vanilla, non-ESG MSCI ETFs.

Retail and institutional investors alike are using these ETFs to make a meaningful and measurable impact on global issues like climate change. They can also be combinded to achieve the desired asset allocation between developed and emerging markets.

A key consideration when debating the exclusion versus transition philosophies is the sustainability of each approach.

We want to do the right thing. We see and acknowledge the destructive threat of climate change, of poor governance, of societal inequalities. In the same breath, we are swayed by a biological instinct to look after ourselves and those we care about.

As a result, governments, businesses and investors will likely balk at or subvert hard-line ESG initiatives they perceive as harmful to their own interests.

The transition approach – whether in the context of energy production, supply chain management, or portfolio construction – has a just and collaborative ethos that promotes sustainable buy-in from each of the important stakeholders. A practical path to prosperity is the sustainable one.

Satrix Managers (RF) (Pty) Limited a registered and approved Manager in Collective Investment Schemes in Securities. Collective investment schemes are generally medium- to long-term investments. Past performance is not necessarily a guide to future performance, and that the value of investments/units/unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available from the Manager on request. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. A feeder fund is a portfolio that invests in a single portfolio of a collective investment scheme, which levies its own charges and which could result in a higher fee structure for the feeder fund. The manager has the right to close the portfolio to new investors in order to manager it more efficiently in accordance with its mandate.