CHOOSE YOUR PLATFORM

Why Are We Here?

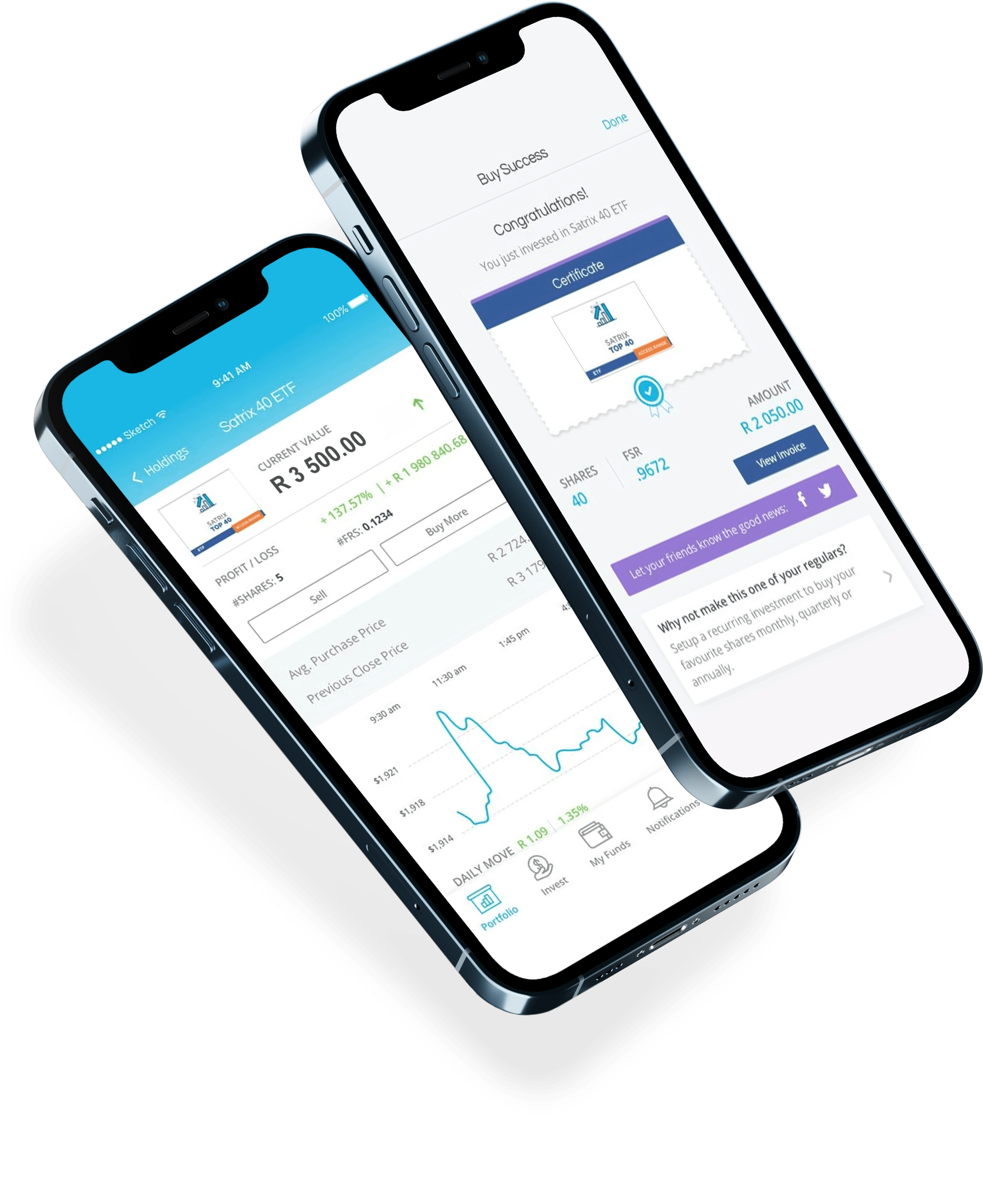

The barriers to investing are often high. Funds can be difficult to understand; the minimum investment amounts are too high; the application process too complicated; the fees too steep. We are breaking through those defences so anyone can own the market.

How Do We Do That?

Through a deep understanding of our customers and innovation. We listen so we can learn about what prevents South Africans from investing. Then we use tech-driven innovation to solve their challenges. Our country's first ever exchange-traded fund, first smart beta product, and first, no-minimum ETF are all Satrix landmarks.

What Should You Expect?

We manage R260* billion for institutional and retail clients, using a range of vanilla and smart beta strategies across ETFs, index-tracking unit trusts, life pools and segregated portfolios. We are the largest index-tracking business in South Africa. Transparency around risk is a core philosophy across all funds because it drives investment returns and informs client suitability. Most of all though, you should expect a simple and rewarding investment experience.

*Source: Satrix, 30 June 2025.