WHICH FUND SHOULD I CHOOSE IN MY TFSA?

Now that you know how a tax-free savings account (TFSA) works, the decision becomes which fund do you invest in, and why?

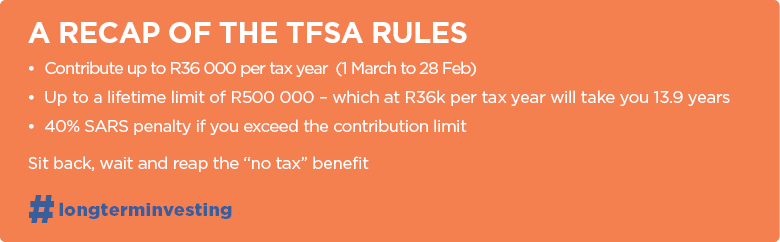

While you do have flexibility in accessing the money in your TFSA, you should view it as part of your long-term investments to reap all the benefits. If you commit to it, it will take you 13.9 years to reach your lifetime contribution limit.

All Satrix products track an index which means you get similar performance to the stock market over time. For example, the Satrix Top 40 Index Fund tracks the FTSE/JSE Top 40 index. So instead of you buying each and every share in the Top 40 index, Satrix does it for you, simply, in one fund and at low cost.

If you do commit to being a long-term investor, you can invest in any of our index tracking products which give you stock market exposure because you have time on your side. It is important to note that you do not need to choose only one ETF or unit trust. You can hold as many as you like in your TFSA. Remember that the contribution limit applies across all your tax-free savings accounts.

MULTI-ASSET FUNDS OFFER DIVERSIFICATION

If investing 100% in a fund which tracks a stock market index feels a bit daunting because you know that the stock market can be volatile at times, then it may be better to consider one of our multi-asset class funds.

What do we mean by multi-asset class? Asset classes are securities you can invest in like shares, bonds, listed property and cash. By considering Satrix’s multi-asset or balanced funds (which are diversified portfolios investing across all asset classes including equities, property, cash, bonds and offshore investments in a single fund) you are getting the best of all worlds. You will be diversifying your investments and lowering the risk of some of the higher risk asset classes in the fund like equities, allowing a moderate or conservative investor to find a fund which suits their risk profile. The Satrix Balanced Index Fund and the Satrix Low Equity Balanced Index Fund are well-suited to these requirements.

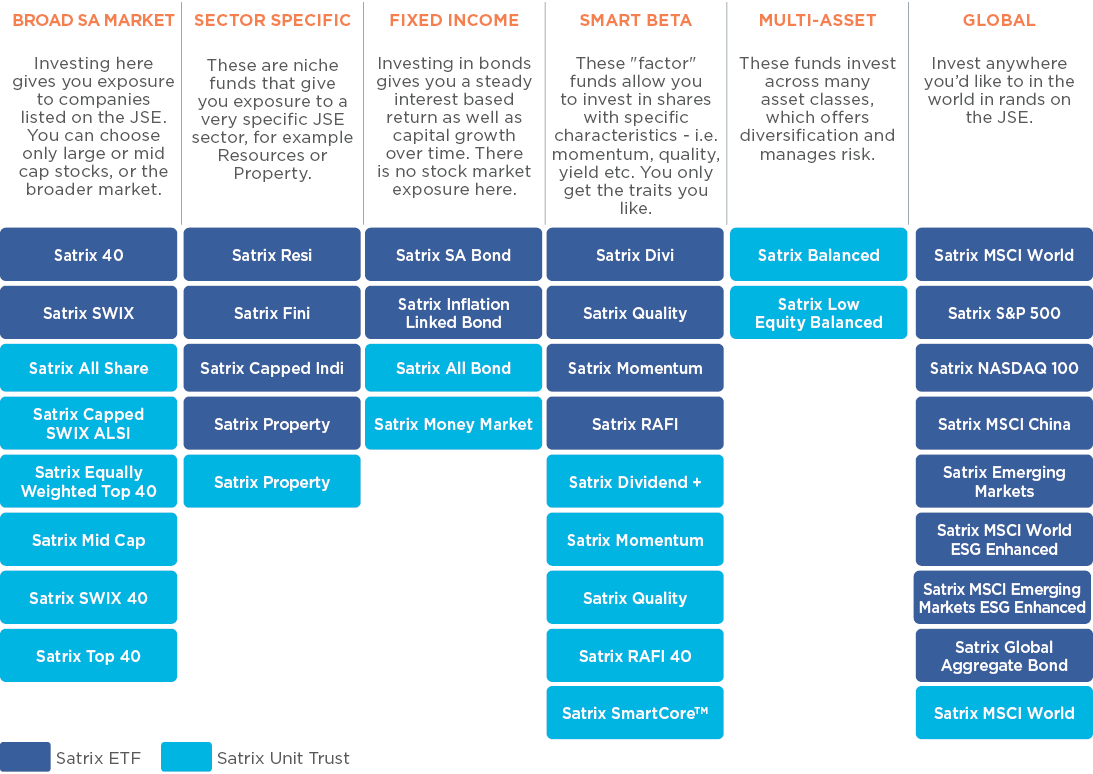

SATRIX UNIT TRUSTS AND ETFs ARE ALL AVAILABLE AS TAX-FREE OPTIONS

Satrix has a broad range of ETFs and Unit Trusts available for you to use in your TFSA through www.satrixnow.co.za .

We’ve grouped them below to make the choice simpler – in some cases we have an ETF and a Unit Trust which track the same index.

GETTING THE MOST OUT OF YOUR TAX-FREE ACCOUNT

Once you’ve chosen the ETFs and unit trusts you want to invest in, you can add to your tax-free success by following these simple pointers:

Maximise your contributions – if possible, use your full annual allowance each tax year (currently R36 000). This way you will reach your life time maximum contributions of R500 000 as quickly as possible, giving your investment time to compound performance.

Invest for the long-term – you should try as hard as possible to stay invested in your TFSA for the full time-frame, but equally important is where you invest. If you have a long-term mindset you can take on more risk because time is on your side. Consider this carefully when choosing your ETF or unit trust.

Don’t make withdrawals – view this investment as part of your long-term investing plan. You are able to make withdrawals from your TFSA at any time, but if you do withdraw cash from your account, you can’t replace it during that tax year. You will essentially have used up some of your life time maximum savings of R500 000. You cannot use the account like you would your bank account. You need to view this as a long-term savings account.

A diversified, cost-effective portfolio can be attained by combining local and global exposure. The global component also offers a hedge against rand weakness.

One more attractive characteristic of index-tracking products is that they are all low cost. Remember the lower the cost of your investment, the more performance you get to keep for yourself. This makes perfect sense, so keep it in mind.

If you still have questions, please visit our SatrixNOW Tax-Free FAQs, the answers you need may be there.