Opportunity in Chaos?

There is no hiding from the current misery inflicted on global capital markets. Most stock markets have had a bruising month and year so far, with investors fleeing riskier assets for several connected reasons.

First, slower post-pandemic global economic growth and trade have been further hamstrung by soaring inflation and deepening trade rifts between the largest economic powers. Russia’s war in Ukraine has caused even more fuel and food price inflation, prompting central banks (most notably the Federal Reserve) to hike interest rates aggressively – and indicate a willingness to keep doing so in order to rein in prices. Many investors, fearing an end to highly accommodative monetary assistance from central bank institutions, have sold off their equity holdings in response.

Amidst all this uncertainty and volatility, understandably investors are considering redeeming their investments, particularly in risk assets, and locking in recent losses. It is important, especially during periods of volatility, that investors stay the course – and see the opportunity presented when markets do in fact retreat. Investors would be wise to take comfort that, while painful, recent market turmoil and uncertainty are by no means unique to our times.

Investors seriously considering changing their investment habits should consider a few key points before doing so:

First, a clear distinction needs to be made between investing and saving. We invest to build wealth and ensure long-term financial security. We save to meet short-term liquidity needs (a rainy-day fund, and larger annual expenses like school fees and holiday expenses).

When investing, our focus is not on short-term market gyrations. When driving long distance, we are not distracted by winding roads or inclement weather, but rather guided by our desire to reach our intended destination.

Secondly and related to the first, when investing long term - the key is consistency. If you invest regularly and with discipline, you can contextualise and even celebrate any market condition: if market prices rise, your accumulated wealth grows. If markets fall, you are buying exposure more cheaply. Either direction you win. Building wealth is about building market exposure through time – and the best way to do this is not to try and find the best entry points, but rather to allocate consistently and benefit from compounding returns over time.

Some suggestions to investors in the midst of uncertainty in coming months:

- Equity markets do experience periods of correction. Prepare yourself mentally to weather such storms and try not be swayed by short-term news and surprises.

- Clearly separate out what you invest (which is for the long term) and what you save (which is for meeting short-term obligations), and try not to make investment decisions based on short-term considerations.

- Remember that losing money on an investment is painful – there’s no denying it – but the pain of not building exposure to equity markets over the long term, although not felt as acutely, is far greater.

- Force yourself to invest more frequently and more consistently. Good habits only grow by being deliberate. It is more important to spend time in the market than to try and time the market.

Easy to digest numbers:

If you invested R1 in the FTSE/JSE All Share Index over the past 25 years on any given day – what are the odds that you earned a positive return over one year? What are the odds you earned a return above the long-term inflation level of 6% over one year?

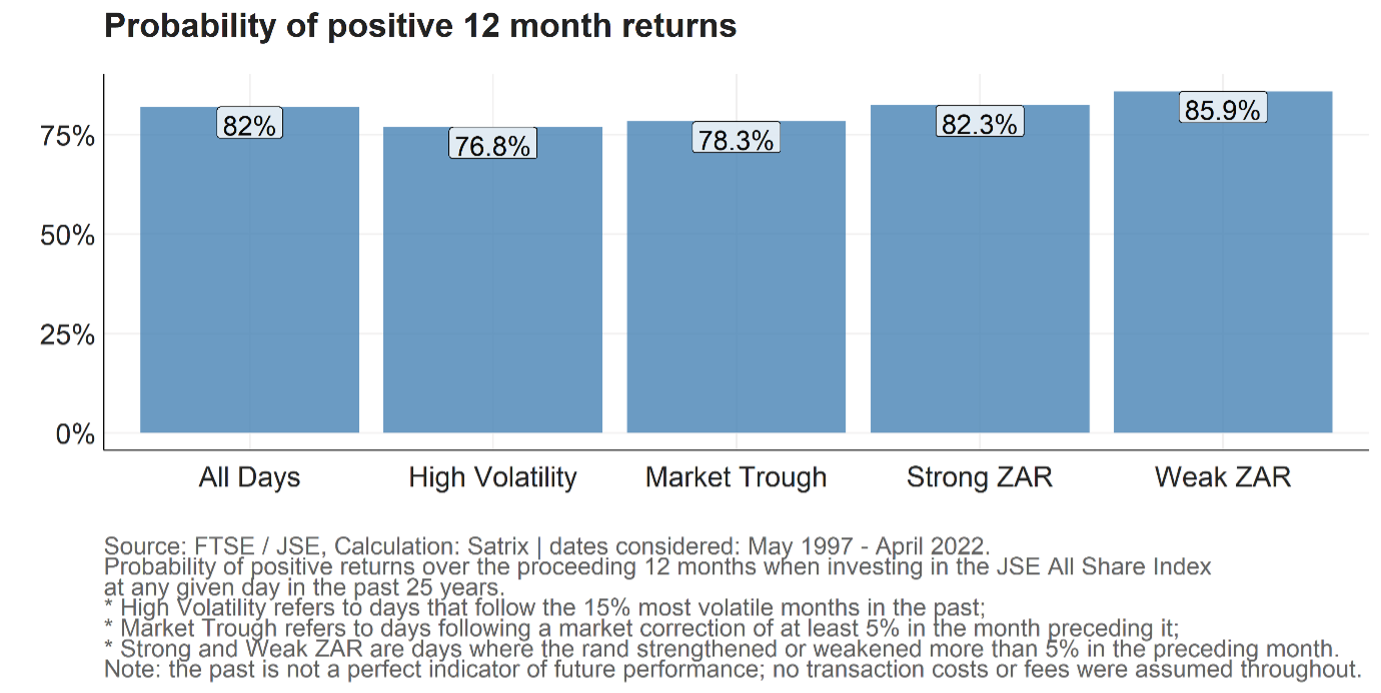

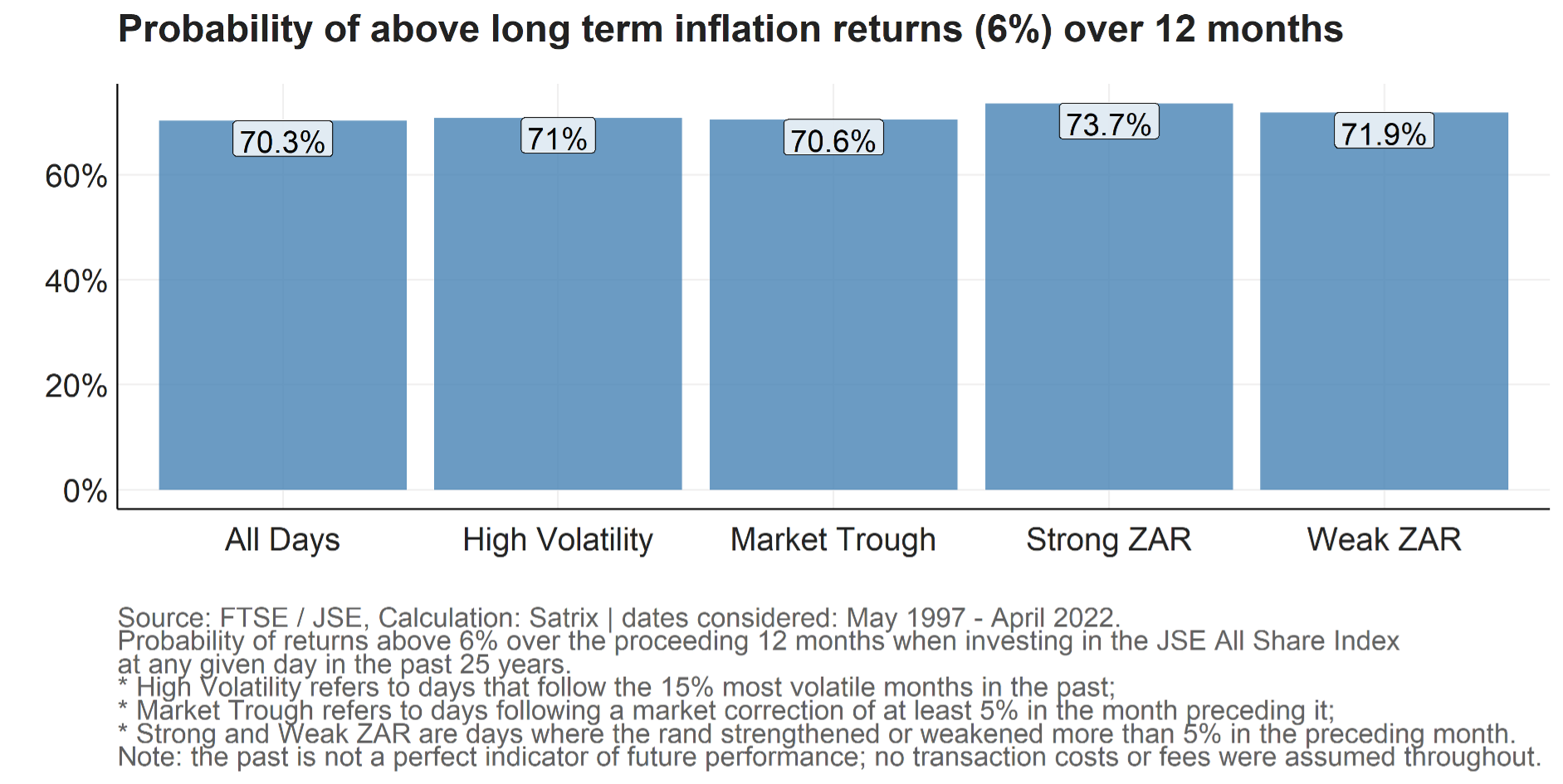

Below we calculate these probabilities, noting that irrespective of when you invested (“all days” mean any given day, “high volatility days” are days when the index experienced high volatility in the preceding month (top 15% overall range), “market trough days” are when the market experienced a more than 5% slump during the month prior, while “strong and weak ZAR” represent days where the rand appreciated / depreciated by more than 5% in the preceding month. Notice that for all these distinct days, the probability of at least preserving capital is between 75% and 80%. The second figure shows that beating long-term inflation of 6% has similarly high odds (between ~70% and 75%), with the odds slightly more in your favour should you be experiencing currency or market volatility.

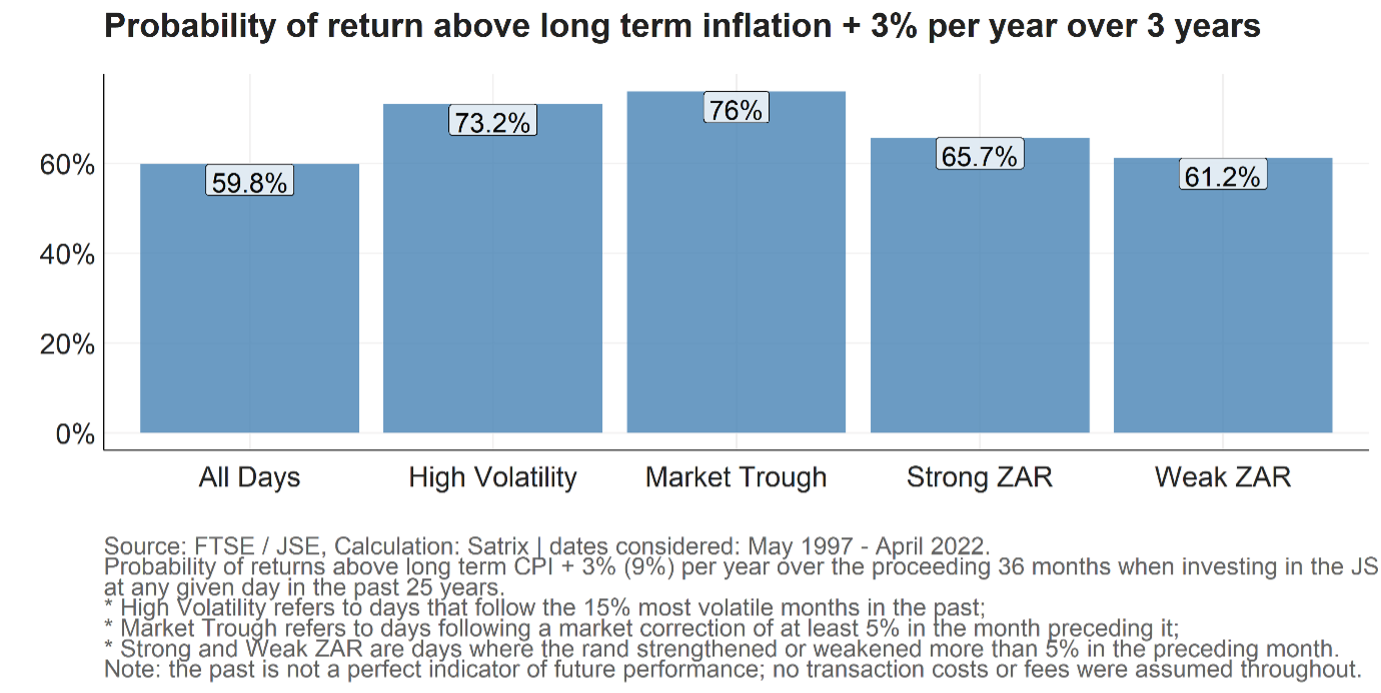

What is even more compelling is that when we raise the bar and look at the probability of earning a decent real return of long term CPI + 3% (i.e., above 9% return) for each year over a three year period, when investing R1 in the All Share Index on any given day in the past 25 years, the odds remain stacked in the investor’s favour. Interestingly, if the period preceding the investment date had high volatility or experienced a market drawdown – the probability increased to three quarters.

A note of caution applies. Any investment in variable return assets like the stock market has the probability of underperformance, and past performance is certainly not an indication of future performance. However, if history offers us any guidance in terms of long-term wealth creation, it would be that now is always the best time to start investing for the long term. Rather than trying to time when to buy assets, the important thing is to build exposure to wealth-creating assets consistently and with discipline.