Invest in the rise of smart cities

The pandemic may have slowed the megatrend of urbanisation. But cities will continue to offer magnetic economic and social benefits – it’s estimated that 60% of the global population, some five billion people, will call them home by 2030.

But just as people are drawn to cities, businesses gravitate towards the challenges arising from urbanisation. What makes such innovators an interesting investment proposition today?

The proliferation of data, and the ability to make sense of it using technologies like artificial intelligence and machine learning, gives them the tools to decode the complexities of urban living to deliver innovative services and products that make a real impact.

If these companies have a shared vision, it’s one in which resources are used more efficiently, where everyone is connected, and people live better and healthier lives. They call it a smart city. The companies at the forefront of that vision make for compelling investments.

Satrix Smart City Infrastructure Feeder ETF

Urbanisation is not the only driving force behind the development of smart cities. Climate change adaptation, aging populations and continued technological breakthroughs, all identified as key megatrends by BlackRock, will also play their part.

To give our clients access to the city-changing innovation that is afoot, we have launched the Satrix Smart City Infrastructure Feeder ETF.

The ETF tracks the STOXX Global Smart City Infrastructure Index which provides exposure to companies that find opportunities in the complexity of urbanisation. It will list on the JSE, and investors will access it in South African Rand.

The fund also aims to advance the following Sustainable Development Goals (SDGs) outlined by the United Nations:

6: Clean Water and Sanitation

7: Affordable and Clean Energy

9: Industry, Innovation, and Infrastructure

11: Sustainable Cities and Communities

12: Responsible Consumption and Production

About the STOXX Global Smart City Infrastructure Index

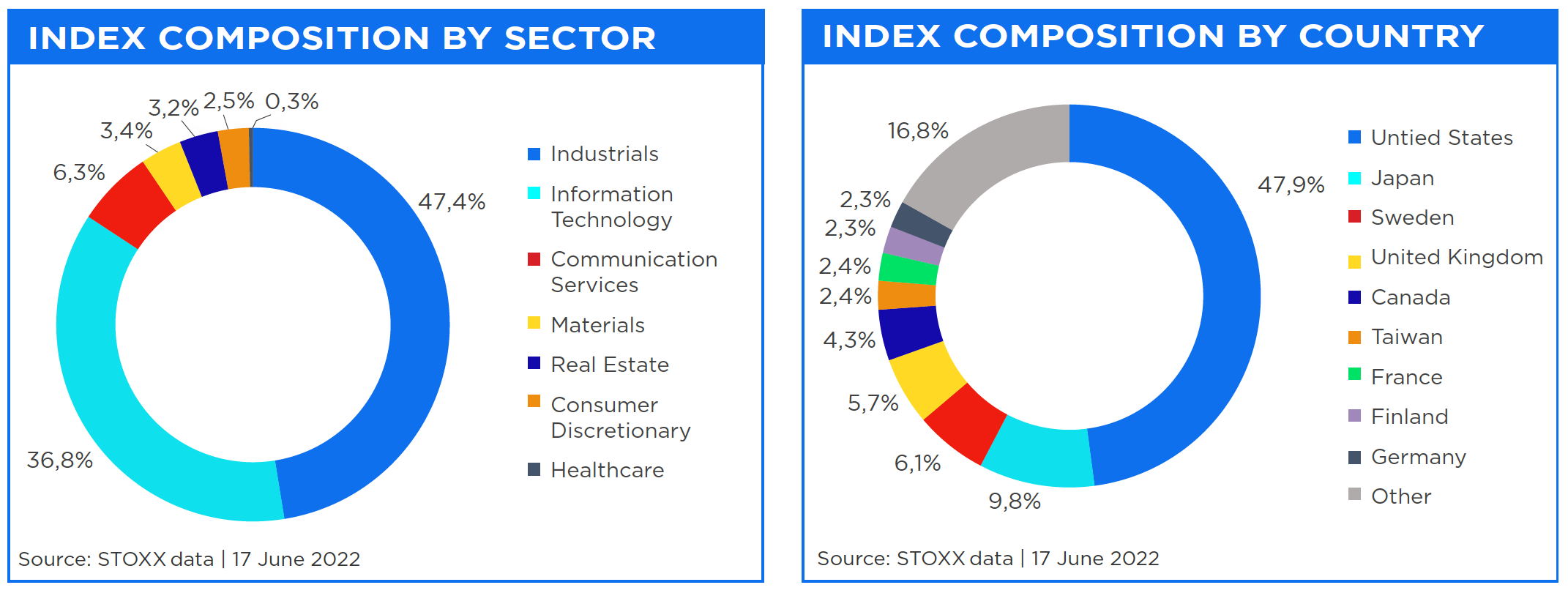

The STOXX Global Smart City Infrastructure Index is comprised of companies that operate in three broad smart city categories:

Resource efficiency

Solving the challenges around the provision of affordable clean energy, access to clean water and sanitation and the management and treatment of waste.

Urban connectivity

Developing the 5G and database infrastructure needed to create digitally connected cities, enable the internet of things (IoT), and drive efficient urban transportation systems.

Citizen wellbeing

Addressing the issues of inefficient city management and the environmental factors that impact citizen wellbeing, such as transportation and traffic safety.

The index employs an “adjusted” equal weighting methodology to achieve a balance between diversification and liquidity. It also scores highly based on ESG screening criteria.

Who should invest in this ETF?

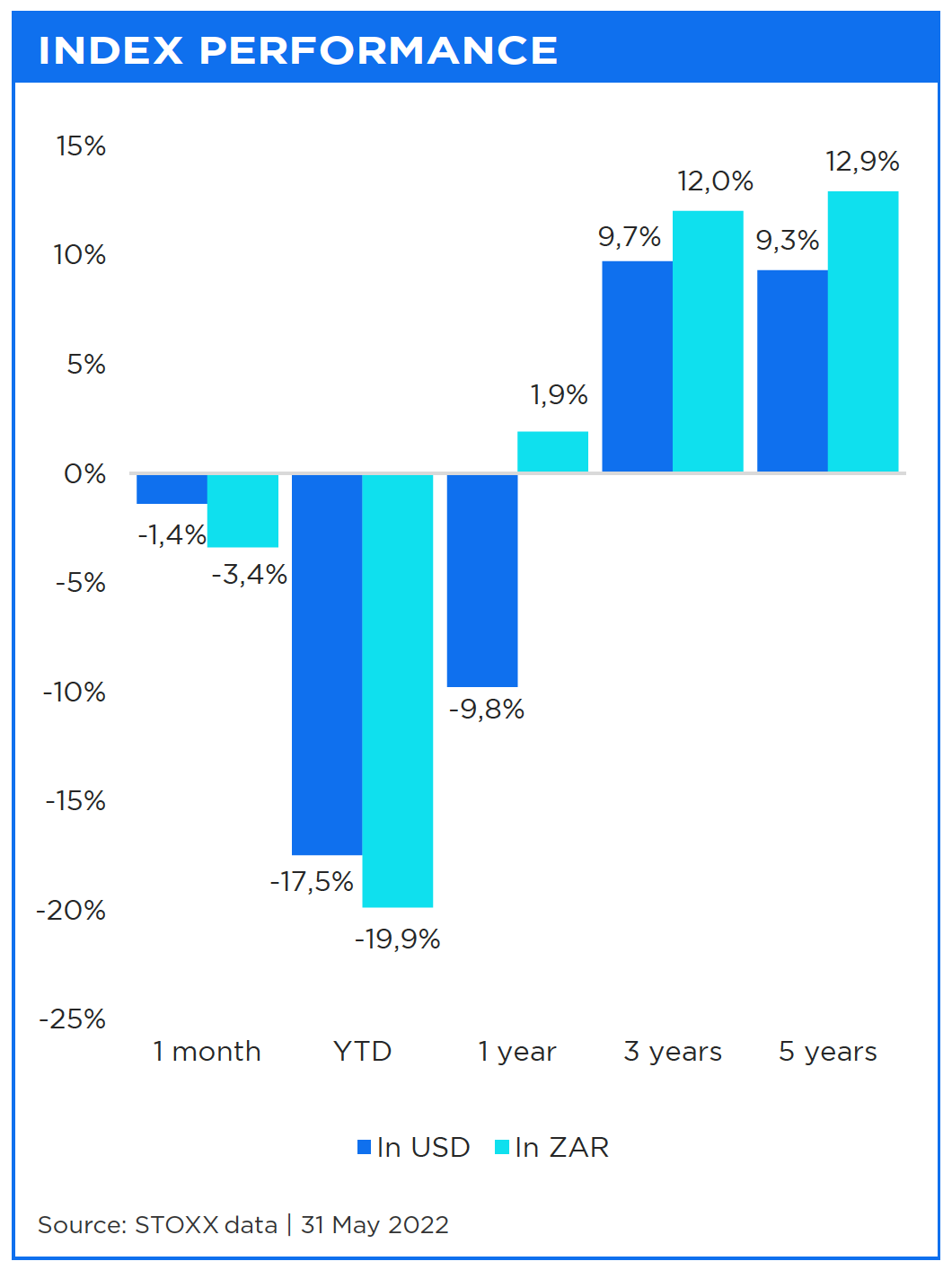

This ETF is suitable for investors with a long-term investment horizon who would like exposure to the megatrend of urbanisation and the potential opportunities of smart city development. Investors should expect and be able to withstand equity-like volatility.

How to invest

Existing investor: You can access the Satrix Smart City Infrastructure Feeder ETF via SatrixNOW, which requires no minimum investment amount.

New investor: If you don’t yet have a SatrixNOW account, you can register here.

It will also be available via other investment platforms and personal stockbroking accounts.

Download the IPO Information Sheet and Minimum Disclosure Document.

Satrix Managers (RF) (Pty) Ltd (Satrix) a registered and approved Manager in Collective Investment Schemes in Securities. Collective investment schemes are generally medium- to long-term investments. Unit Trusts and ETFs the investor essentially owns a “proportionate share” (in proportion to the participatory interest held in the fund) of the underlying investments held by the fund. With Unit Trusts, the investor holds participatory units issued by the fund while in the case of an ETF, the participatory interest, while issued by the fund, comprises a listed security traded on the stock exchange. ETFs are index tracking funds, registered as a Collective Investment, and can be traded by any stockbroker on the stock exchange or via Investment Plans and online trading platforms. ETFs may incur additional costs due to it being listed on the JSE. Past performance is not necessarily a guide to future performance and the value of investments / units may go up or down. A schedule of fees and charges, and maximum commissions are available on the Minimum Disclosure Document or upon request from the Manager. Collective investments are traded at ruling prices. A feeder fund is a portfolio that invests in a single portfolio of a collective investment scheme, which levies its own charges, and which could result in a higher fee structure for the feeder fund. International investments or investments in foreign securities could be accompanied by additional risks such as potential constraints on liquidity and repatriation of funds, macroeconomic risk, political risk, foreign exchange risk, tax risk, settlement risk as well as potential limitations on the availability of market information. The manager has the right to close the portfolio to new investors in order to manage it more efficiently in accordance with its mandate. Satrix Investments (Pty) Ltd is an authorised financial service provider in terms of the Financial Advisory and Intermediary Services Act, 2002.