“Both a retirement annuity (RA) and a tax-free savings account (TFSA) save you tax, but in different ways,” explains Duma Mxenge, Business Development Manager at Satrix. “Your RA is a pension funding vehicle, and by contributing to it, your taxable income is reduced, which is an immediate tax saving in your monthly income in comparison to your TFSA. Your TFSA gives you tax relief at the end of the savings period by saving you from paying capital gains tax, tax on interest income and dividends tax.”

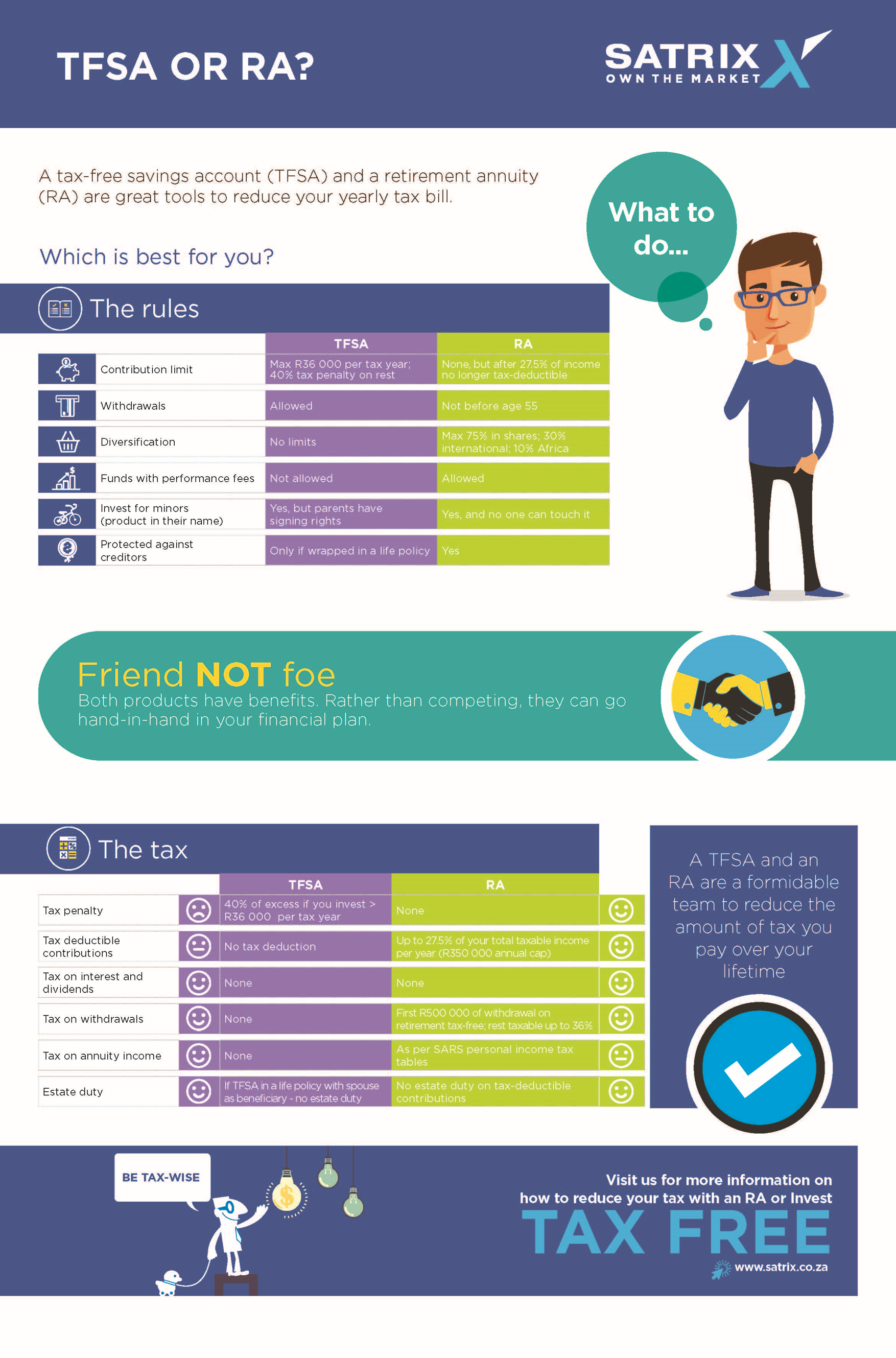

In the tables below, Satrix outlines the rules and restrictions for each option.

Disclaimer:

Satrix Investments (Pty) Ltd is an approved FSP in term of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision.

While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSP’s, its shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaims all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.