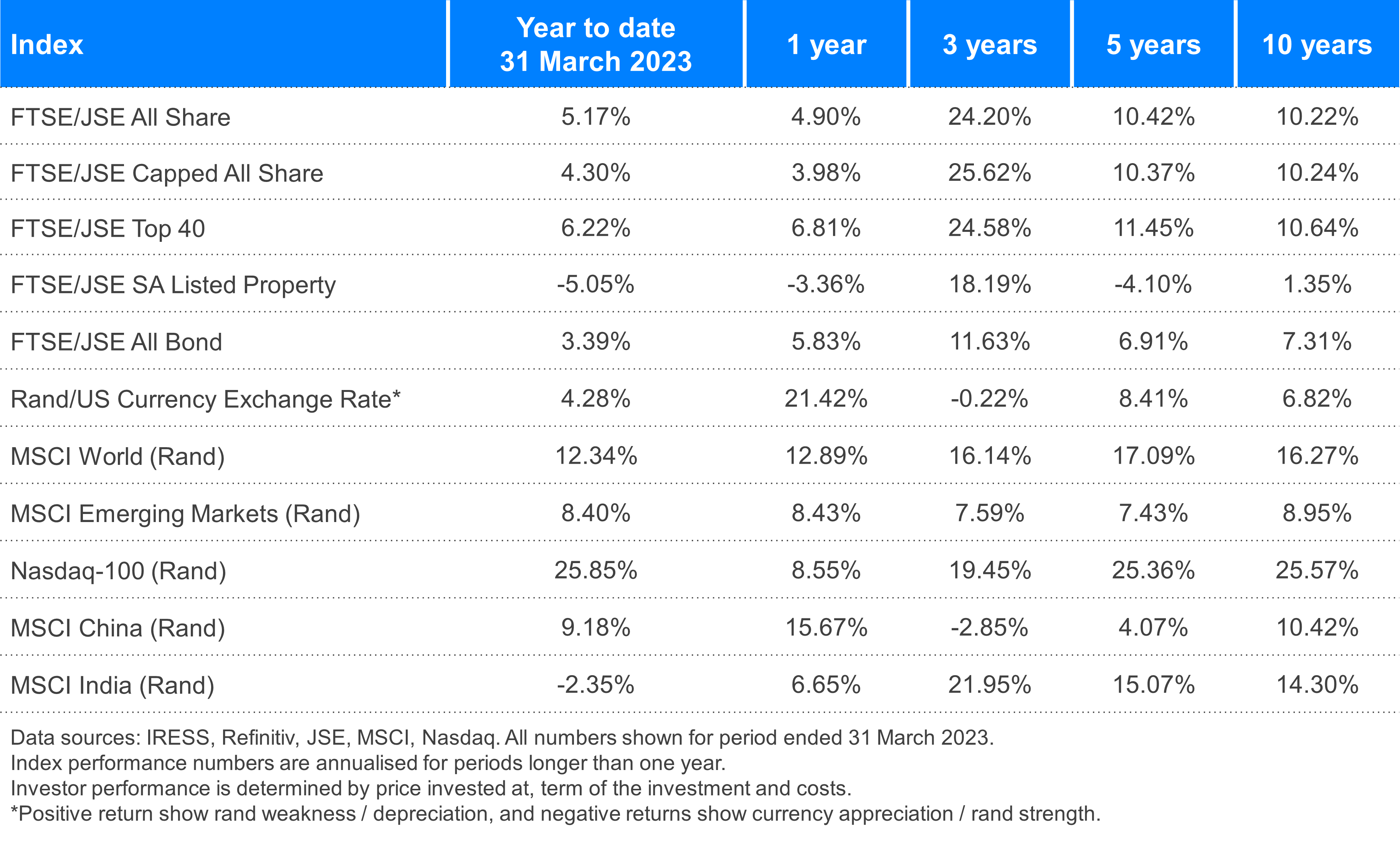

2022 was a shock to many, especially those who invest on their own and don’t seek any financial advice, even seasoned investors were puzzled by the market volatility. But, investors have experienced a more positive start to the year, while remaining cautiously optimistic. The banking sector did not have a good month though. US-based banks, Silicon Valley and Signature Bank, and Credit Suisse in Switzerland collapsed. The US recession fears continued and the bank collapses also helped fuel this fear. But the market has pockets of opportunities with other sectors doing well during the month of March. With over 90 ETFs listed on the JSE stock exchange, the best performers year-to-date, were ETFs with a big focus on Tech stocks like the Satrix NASDAQ 100 ETF, which saw its index end the month up by 5.9% in Rand terms. Tech stock valuations are quite stretched, and with the central banks continuing to raise rates and tech companies laying off staff by the 1000s, caution still remains. Year-to-date the Nasdaq 100 Index is up 25.8% in rand terms, but it is still a long way to its December 2021 peak. Globally, the Banking sector was in disarray which also translated to the local listed financial sector being hit for the month. JSE listed Financial stocks took the hardest knock during the month of March, down 5.8% for the month, while Industrials were down 0.9%. Resource stocks were the sector that did very well in March, up 4.7% for the month as metal prices including Gold were strong for the quarter, while property was down 3.4%. Borrowing costs have skyrocketed in South Africa and just like the other offshore markets, inflation looked like it is the one that is holding all the cards for this year as well. Inflation in South Africa peeped 7% in a period where it was seen as cooling, this then translated to SARB increasing the repo rate by 50 basis points; higher than the expected 25 basis points, sending shockwaves to the markets. Though inflation has been high, the Cash returns in South Africa proved to be superior, with the STEFI composite returning 0.6% for the month, giving the investor a higher than inflation return on an annualized basis. For any investor that is looking to get exposure to Cash-like returns, they can simply invest into the Satrix Money Market Unit Trust. On foreign equity, the US tends to be looked at as the safe haven when there are market downturns and this was seen when the 2008 financial crisis started, which ironically originated in the US, but saw the dollar strengthening while indices outside the US also underperformed the S&P 500 Index. While recession fears loomed; for the month of March, the S&P500 index was fairly flat at 0.2% while the MSCI World index, which has over 60% weighting in US companies was down 0.4% for the month, in Rand terms. Outside that, the MSCI China index was up 1%, a strong alternative and a market that has rallied since the beginning of the year. It is easy to get distracted when seeing a lot of market volatility, but investing for the long-term always takes priority in the decision making. It hardly ever happens that all asset types are doing badly, and all the markets around the world are tanking, so even through investor fears are there and volatility increases; the markets have proven time and time again that they will always provide an investment opportunity.

Satrix Scoops Nine Awards at SALTA

Satrix is delighted to have received nine South African Tracker Funds Awards (SALTA), including our 6th consecutive People's Choice award for the favourite South African ETF (by popular vote) at the event hosted at the JSE in Johannesburg last week, 30 March 2023. Thank you for your support! Read more here. Disclosure Satrix Investments (Pty) Ltd is an approved FSP in term of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision. While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSP’s, its shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaims all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information. Disclaimer |