After a stellar start to the year, with strong market returns for January, the rest of the first quarter looked like the markets were heading for more downturns. February and March shaved off close to a third of January’s returns in local equity markets. April saw a massive rally in the markets, to such an extent that it made up all the losses incurred during February and March. The FTSE/JSE All Share Index was up 8.9% in January, and is up 8.7% for the year to end-April.

There’s been much talk about inflation cooling, but even with banks continuously increasing repo rates, inflation seems to be persistent in some markets including South Africa. Despite this, the rate of change has slowed as the SA inflation rate went up by only 0.1% in March this year. In the US, inflation slowed to its lowest level since May 2021, which further pushed rebounds in capital markets around the world.

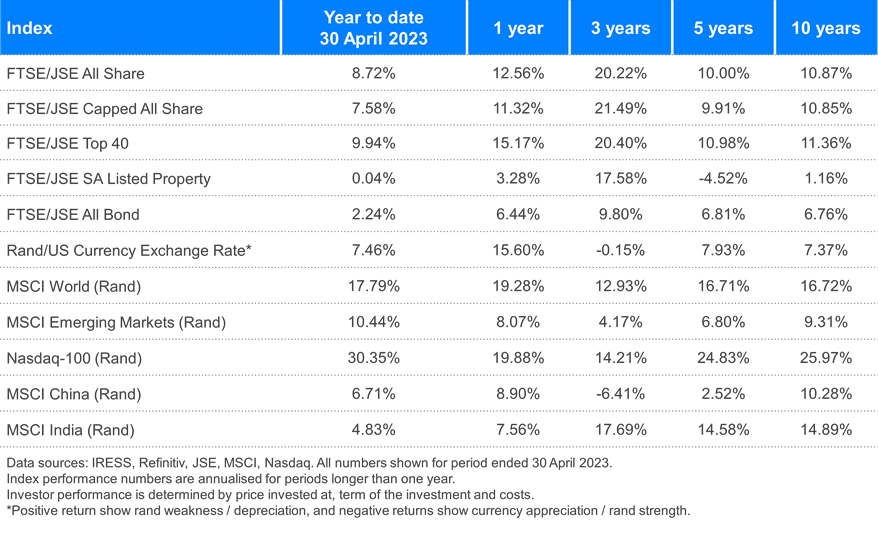

Offshore exposure still shows strength in terms of returns when compared to local indices. The weakening rand - which depreciated by 3.1% in April - has also assisted, giving local investors an opportunity to diversify away from more locally-focussed shares. If you held the Satrix Nasdaq 100 ETF last year, at some point you would have been down 32% for the year. However, the Nasdaq 100 Index has since made up all of its losses from last year and has added some returns. During April, the Index was up 3.6% and year-to-date it is up 30.4% in rand terms, while the MSCI World Index was up 4.9% for the month. The MSCI Emerging Markets Index was up 5.0% for the month, with returns coming largely from India which was up 7.3%, while the MSCI China Index was down 2.3% for the month.

Diversifying Away From Equities

Though South African bonds were down in April (the ALBI was down 1.1%), offshore bonds had a strong month, with the Global Aggregate Bond Index up 3.5% for the month. Cash remains king in South Africa, as the STeFI Composite Index was up 0.6% for the month of April. This translates to an annualised return similar to that of a money market product.

The returns to end-April this year show that being fully invested, even through periods of market volatility and uncertainty, is better than trying to time the markets and potentially locking in any losses. The SatrixNOW investment platform provides you with an opportunity to invest in any of the above-mentioned markets, either through an ETF product or a unit trust.

April 2023 performance

Disclosure

Satrix Investments (Pty) Ltd is an approved FSP in term of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision.

While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSP’s, its shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaims all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.