Weak Rand: Massive Gains for Offshore investors.

In May, the rand to dollar exchange rate reached its highest level ever, closing the month of May at R19.81 to the dollar. This is after it started the month at R18.28, which translates to an 8.38% weakness for the month. South Africa faced risks of being sanctioned by the US as the local government was accused of supplying arms to Russia. The weak currency also came from the SA Reserve Bank unanimously voting to increase interest rates for the 10th time since November 2021 by 50bps, moving borrowing costs to their highest level since May 2009.

Offshore Investment

Apart from the fact that the South African capital markets are significantly smaller compared to developed markets like the US, the currency also plays a big role in how investors choose to diversify their portfolios. Companies like Satrix have made it easy for local investors to access offshore capital markets without moving any currency offshore. There are 44 offshore exchange-traded funds (ETFs) listed on the Johannesburg Stock Exchange; 13 of these are from Satrix and are available on the SatrixNOW platform.

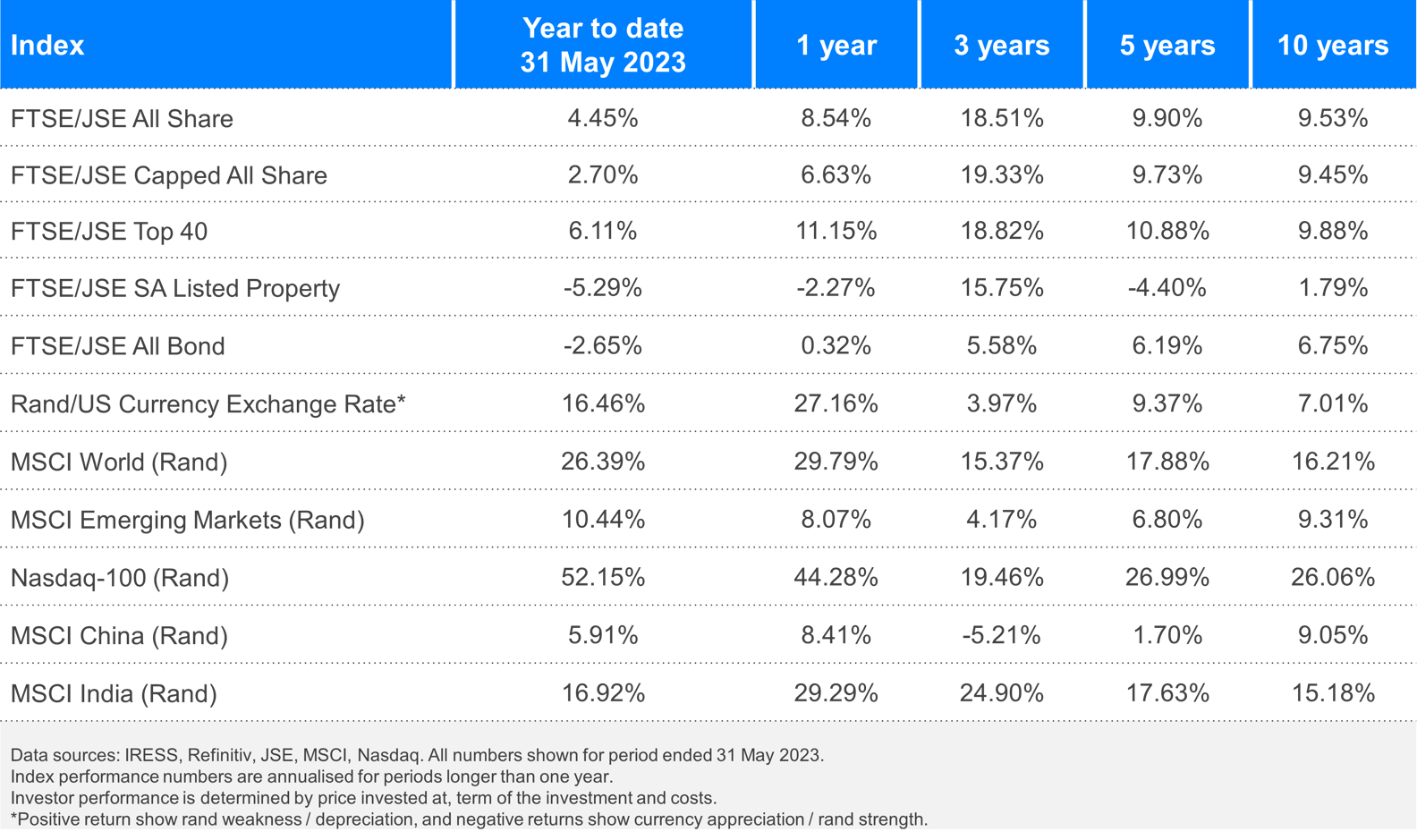

All of these offshore ETFs are rand-denominated, which means if you invest in them your total return experience is subject to two returns: the index return that the ETF tracks, which is in a foreign currency and is then converted back to rand terms – meaning you are also subject to the currency return. Converting from the foreign currency to rand, while holding offshore investments in your portfolio, can be advantageous – especially during a period such as the one we experienced in May where the currency weakened to an all-time high. For example, in US dollar terms, the MSCI World Index was down 1.0% during May but in rand terms the index was up 7.3% for the month. The NASDAQ was the star of the month, up by an astonishing 16.7% in rand terms (up 7.7% in dollars). The MSCI China Index was down 8.4% in dollar terms, but in our local currency the index was down a mere 0.8% for the month.

Local Indices

Since most Resources (like gold, oil etc) trade in the dollar currency, this usually means that companies that trade in precious metals and other basic materials take advantage of the currency weakness to push their revenues up. During the month of May, the FTSE/JSE All Share Index was down 3.9%, driven mostly by Financials, which were down 7.9% and Industrials, which were down 3.9%. The Resource stocks did slightly better than the other sectors and the overall market, as they were down 2.2% for the month. The FTSE/JSE All Bond Index was down 4.8% for the month, and the FTSE/JSE SA Listed Property Index was down 5.3%.

The month of May proved that having an offshore investment as part of your overall portfolio can have major benefits, especially when the rand depreciates. This, however, requires investors to take a long-term investment approach when it comes to offshore investing, as equity markets do fluctuate, and moving out of the market at the wrong time can have an adverse effect on your portfolio. History has shown that investors tend to be rewarded more, by ignoring short-term market movements and sticking to their long-term investment strategy.

Disclosure

Satrix Investments (Pty) Ltd is an approved FSP in term of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision.

While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSP’s, its shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaims all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.