Markets Closed H1 Strong in June

The biggest news stories this year have been around the explosion in interest on generative Artificial Intelligence (AI) and technology stocks have held on to this momentum since the hype that kicked off last year when OpenAI released ChatGPT. As noted in last month’s Fund Focus mailer, we saw Nvidia joining the elite group of companies, including the likes of Apple Inc, that crossed the $1 trillion mark. But the Apple stock did not stop there in June, as it closed the month reaching a $3 trillion market capitalisation, bringing its returns for the year close to 50% in US dollar terms. Apart from technology stocks, other asset classes have also done well this year and had a strong month in June.

Strong Offshore Markets

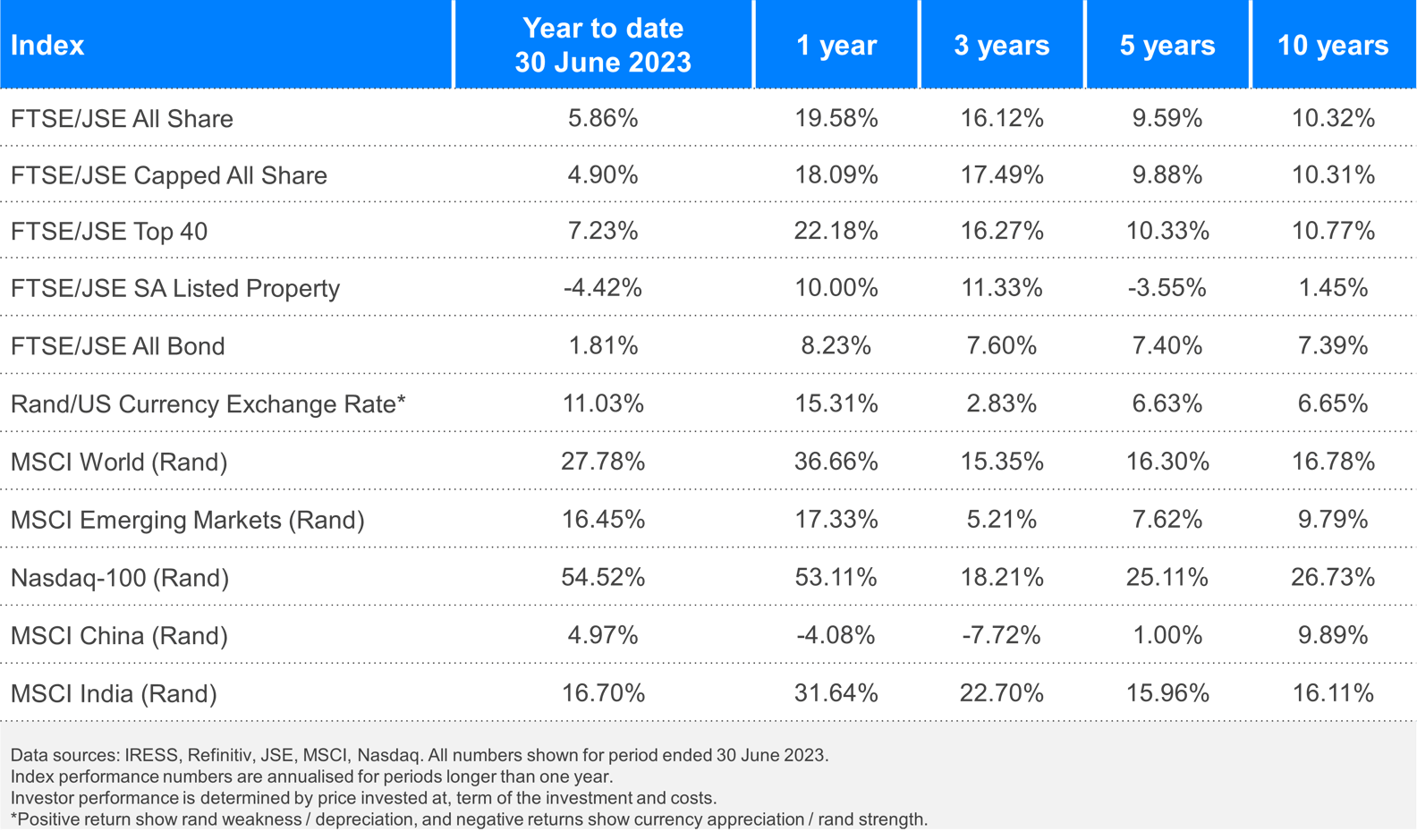

In June the US lifted its debt ceiling once again, and with this the stock markets strengthened. While the US Federal Reserve (US Fed) still had an aggressive tone regarding hiking of interest rates going forward, they paused on raising them after more than a year of consecutive rate hikes. In dollar terms, the Nasdaq Index was up 6.5%, the MSCI World Index was up 6.0% and the S&P 500 index was up 6.6% for the month of June. Year-to-date, the UK markets have also see a fair performance, closing the first half of the year positive as they were up 3.9% in June and the Eurozone was up 4.8% for the month. China and India also had a strong month in June, as they were up 4.0% and 4.7% respectively – in dollar terms, while Global Bonds were flat (-0.01%) for the month.

Financials Led the Local Markets

Banks had an impressive month, averaging an astonishing 11% across the board. Insurers also posted strong numbers during the month, with Discovery, Sanlam, Old Mutual and Santam returning 10.1%,12.4%, 13.6% and 10.9% respectively. This pushed the local markets up, with the FTSE/JSE All Share Index closing up by 1.4% for the month of June. Resources were the worst performing sector on the JSE - down 9.3% for the month, as the rand strengthened by 4.7% to the dollar, while Industrials were up 4.6%. Listed property shares were up 0.9% for the month and the All Bond Index was up 4.6%

Market Movers During the Month

Richemont used to trade on the JSE as a depository receipt but this was restructured this year and the share’s listing status changed to being an inward listed share. Any holder of this share would have noticed a 10:1 change in their portfolio holdings in April. This listing status change translated to the share being down-weighted in the All Share indices, including the FTSE/JSE Top 40 Index and the FTSE/JSE Industrial 25 Index, where Richemont was the the largest share in the index. The share went from 24% to 4% of the Top 40 Index and from 35% to 9% of the Industrial Index. The restructure resulted in R16.8 billion worth of Richemont shares trading in the auction during the FTSE/JSE Index rebalance in June, totalling R24 billion for the entire day in volumes traded publicly on the exchange.

Despite luke-warm results, Naspers had a strong month, along with Prosus, as a result of the market welcoming their announcement on unwinding their complex cross-holding structure which they introduced in 2021. Further details on this restructuring will be made available before the end of this year, as the JSE gears up to harmonise their Africa index series early next year. This will see the Shareholder Weighted (SWIX) products fall away, in order that all indices are treated equally.

Financials Led the Local Markets

Banks had an impressive month, averaging an astonishing 11% across the board. Insurers also posted strong numbers during the month, with Discovery, Sanlam, Old Mutual and Santam returning 10.1%,12.4%, 13.6% and 10.9% respectively. This pushed the local markets up, with the FTSE/JSE All Share Index closing up by 1.4% for the month of June. Resources were the worst performing sector on the JSE - down 9.3% for the month, as the rand strengthened by 4.7% to the dollar, while Industrials were up 4.6%. Listed property shares were up 0.9% for the month and the All Bond Index was up 4.6%

nks had an impressive month, averaging an astonishing 11% across the board. Iinsurers also posted strong numbers during the month, with Discovery, Sanlam, Old Mutual and Santam returning 10.1%,12.4%, 13.6% and 10.9% respectively. This pushed the local markets up, with the FTSE/JSE All Share Index closing up by 1.4% for the month of June. Resources were the worst performing sector on the JSE - down 9.3% for the month, as the rand strengthened by 4.7% to the dollar, while Industrials were up 4.6%. Listed property shares were up 0.9% for the month and the All Bond Index was up 4.6%

July is National Savings Month

July is National Savings Month, a great opportunity to consider how and when you should start your children on their own investment journey. Young people have the unique advantage of having time firmly on their side. By giving children a head start in an investment portfolio, they will be in a great position to harness the power of compound interest – truly one of the greatest gifts parents or guardians can give.

Read more here.

Disclosure

Satrix Investments (Pty) Ltd is an approved FSP in term of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision.

While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSP’s, its shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaims all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.