By Nico Katzke, Head of Portfolio Solutions at Satrix*.

Diversification is an often-cited concept. The virtues of not tying one’s fortunes to a single event has been known for centuries – as Shakespeare eloquently states in the Merchant of Venice:

“My ventures are not in one bottom trusted, … therefore, my merchandise makes me not sad.”

But there is more to diversification than simply being an effective sleep aid. Below, we highlight five important features of diversification to keep in mind when investing.

Diversification is more than just shuffling eggs between baskets…

Most would answer that diversification simply means placing your eggs in different baskets. But if your eggs are in different baskets that are all on the same vehicle, and that vehicle overturns – all your eggs might be broken. This means, the key to diversification is not simply holding many assets, but rather holding different types of assets. An index that holds 1 000 equities might not be diversified at all if equity markets experience a coordinated downturn (as seen in 2008 and 2022). This makes carefully considered portfolio construction a key step in building long-term wealth. It is wise to keep in mind that N-diversification (holding many assets) is not the same as risk-diversification.

Investing is not just about holding the best assets.

This might seem like a very strange statement, but similar to picking the best players for their positions in sport (and not just the 15 quickest or largest players) – building a well-diversified portfolio may mean holding seemingly inferior assets too. These assets can offer important hedging features to your portfolio, shielding against large periodic losses. Although equities offer significantly more upside over the long-term than fixed income instruments, holding alternative assets with lower correlations ensures a smoother long-term investment journey. This feeds into the next point:

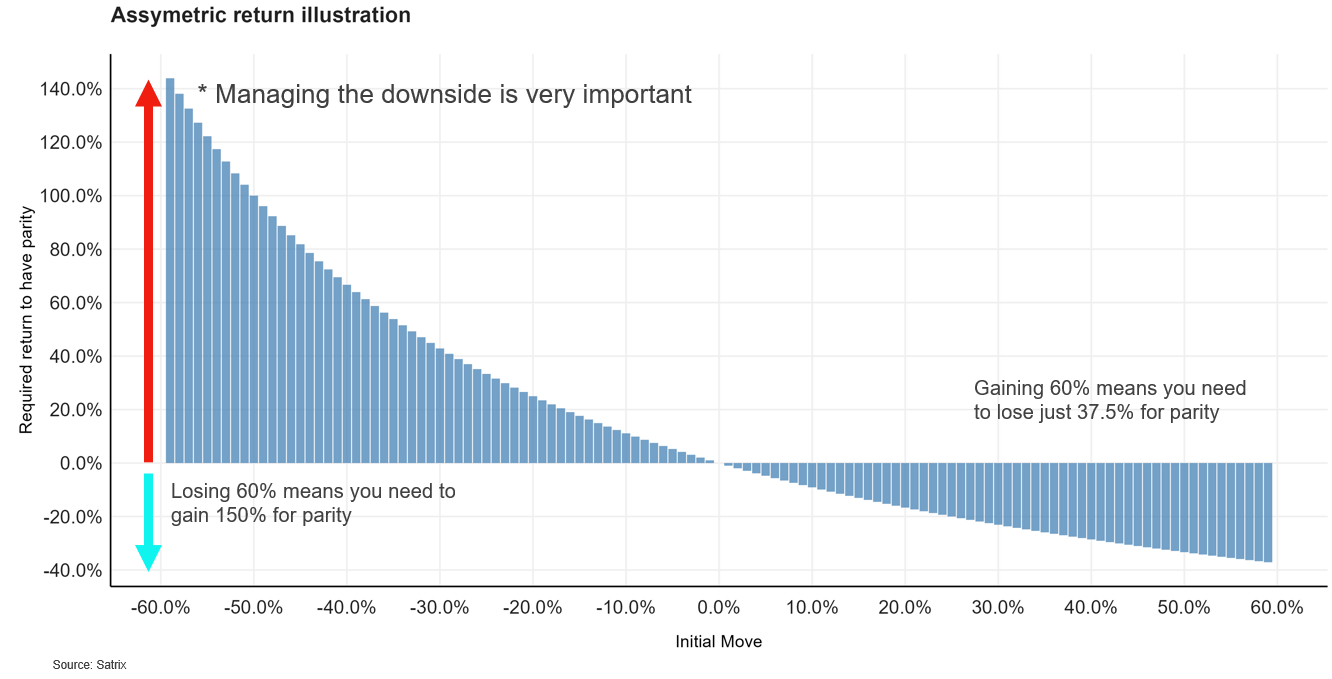

Avoiding downside is (far) more important than capturing upside.

A smoother return profile through diversification has both health and wealth benefits – specifically by helping to better manage downside risk. The impact of gains and losses is not linear. The graph below shows initial price moves on the X-axis, and the subsequent required moves to get back to parity. Notice how steep the required gains are for losses (left) compared to required losses following gains (right). This means that losing 60% requires a gain of 150% to get back to parity, while a gain of 60% is fully offset by a mere loss of 37.5%. The cumulative impact of such large losses is therefore felt for long periods – something investors may not fully appreciate, but should consider carefully.

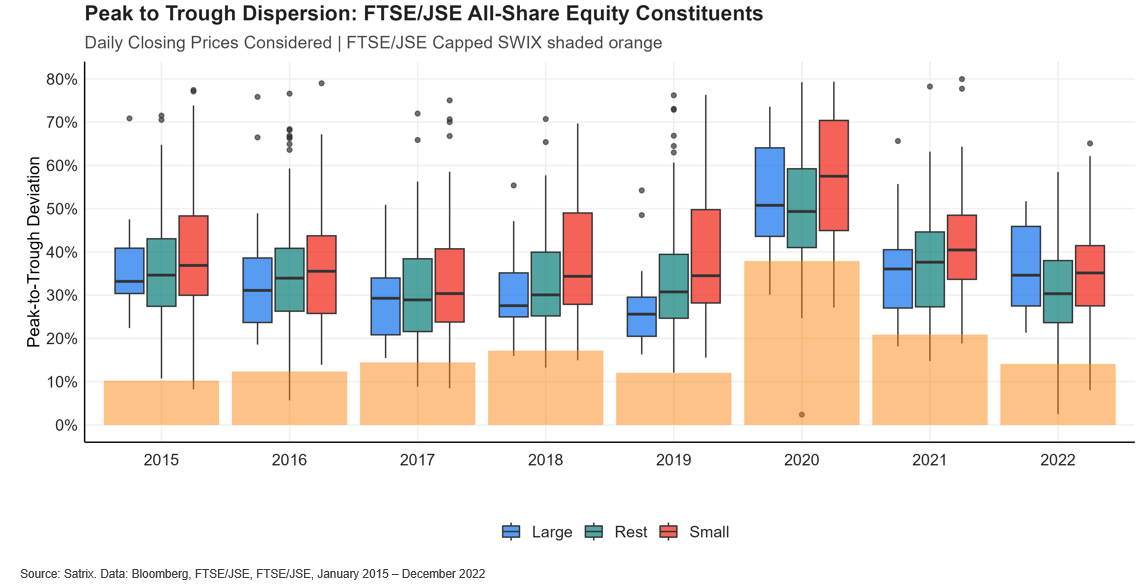

Entry and exit points matter.

Timing entry and exit points can be a precarious exercise. To show this, we plot the peak-to-trough variation for listed local stocks (split between large-, mid- and small caps) per year. The coloured box shows the 20th and 80th percentiles, with the horizontal line in the middle, the average. From this we see that share prices on the FTSE/JSE All Share Index commonly deviate between 30% - 40% per year. This means that even if you take a correct long-term view on a company, the timing of entry and exit points matter greatly. This makes the act of stock picking, by both individuals and even professional fund managers, a high-risk strategy. Contrast this to investing in a simple vanilla index, the FTSE/JSE Capped SWIX Index, which is made up of a diversified combination of listed stocks. The index typically deviates between 10% – 15% (the orange bar), meaning the timing of entry and exit points matter significantly less than when trading individual stocks.

Diversification is thankless.

As diversification is not directly observed, its value in your wealth creation journey is not directly felt and as a result is often underappreciated. This means we have to consciously accept the virtues of a diversified approach to building wealth. But this is easier said than done.

We are often confronted by stories of great investment decisions, with that one friend at a braai reminding you about her recommendation to buy that stock at the beginning of the year that is now 90% up; or the uncle who told you to buy Sasol at R25 per share; or the relative that suggested buying bitcoin when it dipped. We then instinctively do mental accounting and get frustrated at missing out on said opportunities – painfully aware of the comparatively pedestrian returns that our long-term oriented, diversified strategies have earned over that period. Unfortunately, the desire to share poor investment decisions as cautionary tales is not as strong.

But hindsight is a fiendish mistress – and it is tempting to become impatient and act in order to chase the next big payoff opportunity that looked so clear after the fact. In those times of great temptation, it may be wise to remind yourself of the short poem by Ambrose Bierce called A Lacking Factor:

'You acted unwisely,' I cried, 'as you can see by the outcome!’

He calmly eyed me:

‘When choosing the course of my action… I had not the outcome to guide me.’

Not knowing the outcome of our investment decisions in advance means we should not be swayed by short-term returns - and instead focus on what we can control: being well diversified. This is achievable through holding diverse assets and seeking professional help in building a portfolio that can withstand periods of instability. Following this unsexy, thankless route has gold at the end of the road.

*Satrix, a division of Sanlam Investment Management

Disclosure:

Satrix Investments (Pty) Ltd is an approved FSP in term of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision. Satrix Managers is a registered Manager in terms of the Collective Investment Schemes Control Act, 2002.

While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSPs, its shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaims all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.