The Constant Movement of the Market

Markets are complex: there is a lot of movement and flow, and in all the potential chaos, you (as an investor) need to maintain some kind of identity or some form of investment philosophy. This philosophy needs to stand, even with the constant changes in markets and since other variables remain unchanged. In the stock market, nothing stays the same except the fact that you want to beat inflation now and, in the future- otherwise, it’s a gamble.

Organic and Irregular

Much like a river’s identity is reliant on the constant movement of water – your investment journey is also defined by which direction you take risk-wise, your time in the market (not timing the market), branching out into new different asset types for diversification and putting up a brave face in the face of market volatility. Not to be too philosophical, but what really defines a river is the fact that water is always moving– which sets it apart from ponds and lakes. This is what an investment journey looks and feels like, compared to keeping your money under the mattress.

Nothing is ever regular about capital markets, especially when you look at the last three to four years. South Africa’s inflation rate went from 2% at the beginning of 2020 to around 8% in 2023 and is now down to 4.8%. If your target was to match or beat inflation during this period, one thing that should have remained constant was you staying invested. The most organic impact of the fluctuations in inflation came from central banks having to combat inflation from overheating. This then meant that central banks like the US Federal Reserve, the SA Reserve Bank or the European Central Bank had to push rates up – which then had a major impact in the markets and was perhaps also a linear force for some time, which caused many changes in how asset returns behaved.

Hindsight is the worst sight, because suddenly you are able to make the right decision – but you’re not able to go back and revisit that decision. However, there is always a lesson behind the mistake. Investors tend to have very short memories, and most of the time this is where the downfall begins when you manage your own portfolio.

Repetition

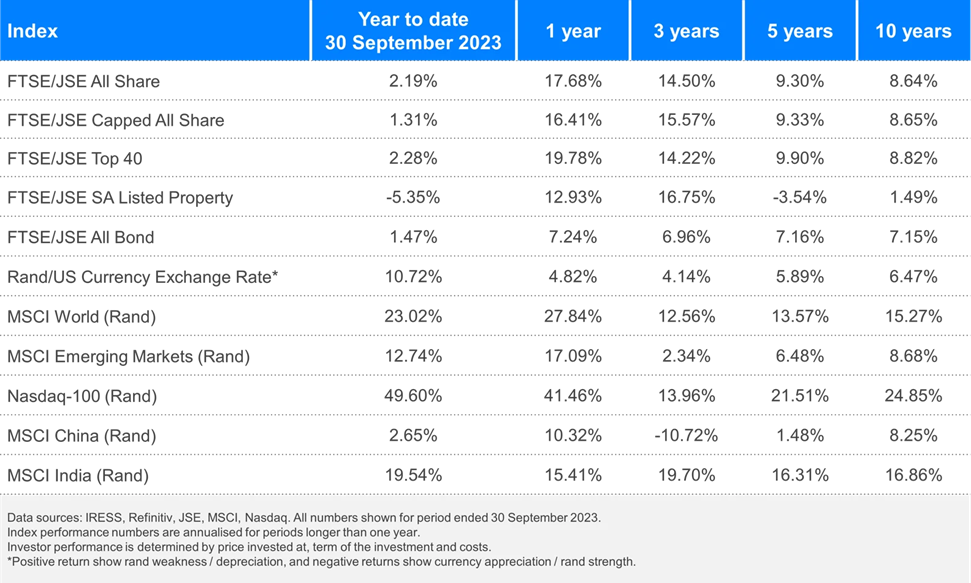

Much like all the returns on your investments compound over time, mistakes also compound and move in the opposite direction – similar to fees on your investments. It is ok to make mistakes, but you do not want to repeat those same mistakes. In September, the FTSE/JSE All Share Index was down 2.5% for the month, mainly driven by Industrials which were down 4.4% for the month, followed by Financials which were down 3.8% and Resources which were flat (+0.6%). Of course, you may have forgotten that the All Share Index was up 15% over the last 12 months to August and has been returning over 9% per annum over the last 10 years. The NASDAQ Index was down 5.5% in September, yet year-to-date the index is up a massive 50% and has been providing 25%+ returns per year over the last 10 years. Emerging markets were also down in September, with the MSCI Emerging Markets Index losing 3.1% in rands, although the MSCI India Index was up 1.2% over the same period. Looking at these numbers one would think investors would remain invested, but it is easy to sell out of an investment when it underperforms.

Investors also tend to be biased and reward past winners. This they do by disinvesting from the past losers, perhaps prematurely at times, thereby locking in losses and then buy into the past winners. Disinvesting totally can also be a big mistake, as this now means you need to time your entry back into the market again. Investing at the right time is actually investing now – it is a long-term game, and you need to stay in it.

Finding Repose and Remaining the Same

As an investor, you will always ask yourself the question – how do you maintain an investment philosophy or structure with so many things changing right in front of you. The answer is to always define your constant variables. Of course, these variables can be changed at any time, but they remain the target. You might be targeting long-term gains, and this usually means you need to remain invested. Inflation changes over time but it’s a constant target to beat. Your ability to define your investment horizon, select asset classes you believe will deliver and then remain invested will get you there. The markets can consistently advance, and also, they can retreat – and as a resilient investor you need to keep repeating your investment strategy, but in doing so you can introduce small changes as these can form a pattern that appears organic and helps you to understand your risk tolerance and how best to manage it.

Disclosure