Market Risks That Come with Conflict

The world has swiftly moved on from working together to combat Covid-19 - which introduced large waves of market volatility that was felt in almost every tradable stock market - to a surge of violence and instability with the Israel-Hamas and Russia-Ukraine wars. The uncertainty these conflicts bring to markets is unavoidable, and there is often no way to time your portfolio positioning.

Unfortunately, wars and conflict often lead to high inflation – which hinders global central banks trying to combat inflation by up-ticking borrowing rates. While the mid-east regions embroiled in the conflict are not major oil producers, the conflict is close to key oil production regions. If the conflict continues, oil price shocks will be unavoidable, more volatility in the markets will be experienced, and central banks will need to revise their interest rate hiking approach – which will also impact how other asset classes will be valued.

The Market Impact So Far

The last three months have left investors no place to hide, unless, of course, they had all their investments in gold and a money market fund. For October, the FTSE/JSE All Share Index was down 3.4%, largely led by industrials which were down 4.6%. Resources were down 3.4% for the month, while financials and property shares were down 2.2% and 3.0% respectively.

The local bond market provided some cushioning over October, with the All-Bond Index (ALBI) up 1.7% during the month, while the STEFI cash index was up 0.7% over the same period. The rand appreciated by 0.5% to the dollar, 0.7% to the euro, and 1.1% to the pound – which did not help to reduce the negative returns coming from the offshore positions.

Global bonds did poorly for the month, as the Global Aggregate Bond Index declined by 1.7% in rand terms, with the US 10-Year Bond yield moving from 4.6% at the end of September to 4.9% at the end of October. Emerging markets were a drag as well, down 4.4% for the month - largely coming from China being down 4.7% for the month and India down 3.5%. The MSCI World Index was down 3.4%, with MSCI US, MSCI UK, and MSCI Euro also down, by 2.8%, 4.6%, and 4.2% respectively – with all returns in ZAR. Gold closed the month very strong, up 7.3% for the month in dollar terms.

What About the Alternatives

Precious metals are often seen as a haven in times of war and market volatility, and the 7.3% return from gold is a good example of this. There are several ways to capture precious metal exposure using JSE-listed ETFs that track the price of gold, palladium, or rhodium, among others.

The Satrix Global Infrastructure Feeder ETF is another alternative to traditional asset class exposure, which tends to offer a different return profile when there is a lot of market volatility. It only lost 1.2% during October compared to the 3.4% loss from the MSCI World Index.

Now What?

Even though these are times of uncertainty, capital markets are older than anyone reading this newsletter. They have been through World Wars, pandemics, and recessions - yet still provided investors with substantial real returns over the years. Short-term jitters should not lead to short-term thinking, and uncertainty is unfortunately something that the markets typically do not like.

Stock markets and the word resilience belong in the same sentence, and investors can sometimes forget that they are in it for the long term once they see drawdowns. Though the Satrix Nasdaq ETF lost 2.5% in October, it is still the second-best performing JSE-listed ETF this year – with returns above 45%.

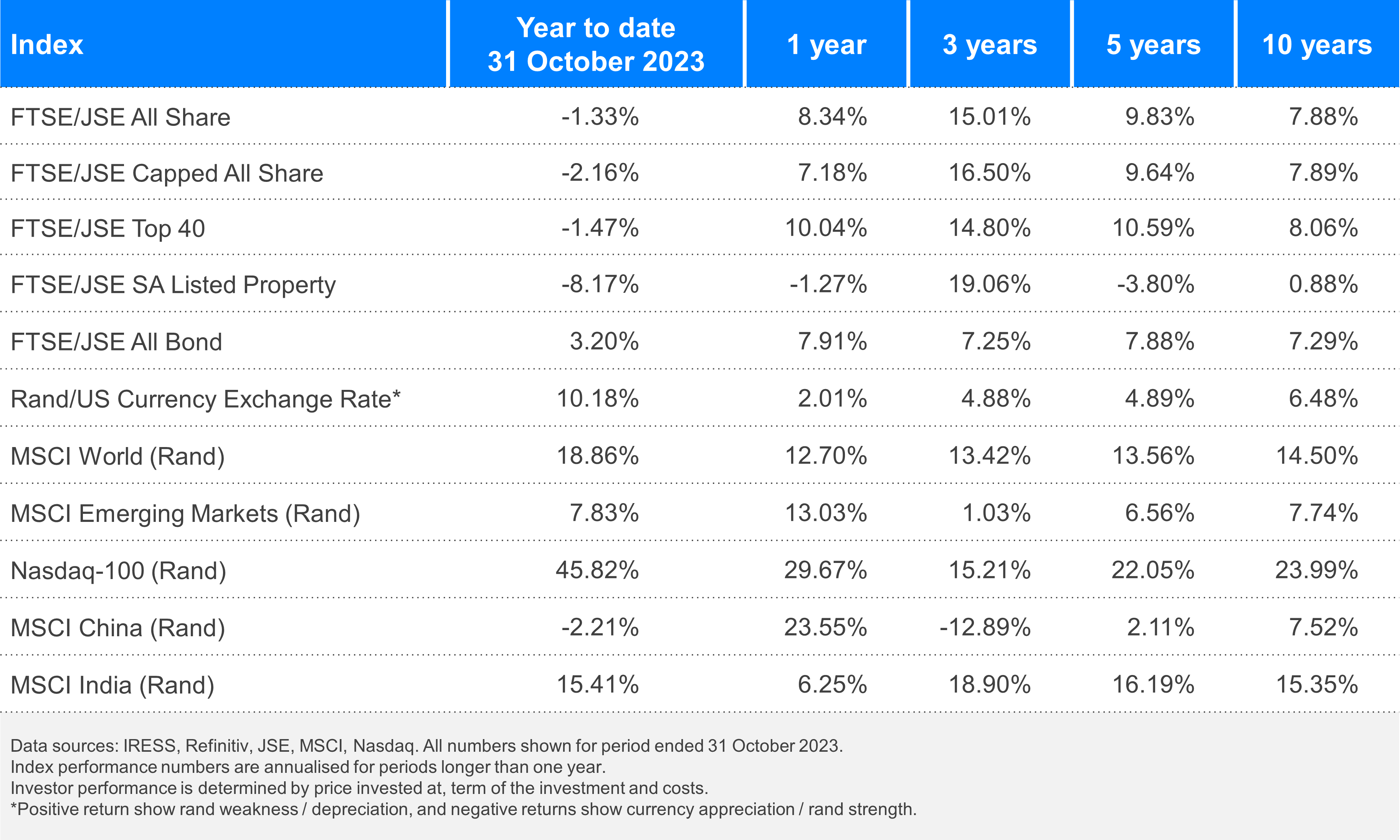

In 2020, the FTSE/JSE All Share Index fell 21% at end of March because of the uncertainty behind Covid-19, yet the index closed that same year up, by 7.0%. The very same index was down 10.4% in the three months preceding November 2023, yet in the last three years it has given investors a 15.0% total return per annum - despite the wars, pandemic, and increased volatility.

Remember - markets are resilient, so stick to your long-term investment strategy and ignore the short-term market movements caused by volatility.

Disclosure