Morningstar reported that a third of European active equity managers outperformed the average passive fund in the one-year period to the end of June 2023. However, in the last decade, only 17.1% of active equity and 23.1% of bond managers outperformed their passive peers, highlighting the compelling value proposition of index-based funds. Global fund flows show more investors than ever are choosing indexation strategies, which Kingsley Williams, CIO of Satrix*, says makes sense, as the odds are stacked against investors in being able to correctly identify an outperforming active fund. Past performance has generally been a poor indicator of future returns.

While the terms indexation and passive are often used interchangeably, Williams says that there’s more nuance to “passive” than the term suggests. Indexation refers to rules-based strategies, where rules could be either vanilla (using only market capitalisation, or company size, often referred to as passive strategies) or non-vanilla, such as factor or thematic strategies. All index strategies, however, share the traits that have proven to be most attractive to investors: they are low-cost, transparent and consistent in design.

Fund Flows Tell the Story

Morningstar makes it clear that while active managers may have had success recently in the volatile global market, the long-term picture shows that index funds are more consistent performers. Its study of almost 26 000 active and index funds indicated that funds’ survival is tied to their success and, typically, index funds outlast their active counterparts.

Williams shares some insight into the explosive growth of rules-based funds:

- Over the last 14-years, index-based funds absorbed 65% of net global flows .

- According to Morningstar, exchange-traded funds (ETFs) in SA now account for 6.3% of market share, and unit trusts are at 7.5%. Among high equity balanced funds, the assets under management (AUM) of rules-based or indexed balanced funds sit at 8.2% but they have attracted an outsized 57.1% of net flows over the last 12-months within the ASISA South African Multi-Asset High Equity category .

- Satrix ETF AUM across linked-investment service provider (LISP) platforms has grown more than six-fold in the past 3 years .

The Arithmetic of Active Management

The simple yet profound Arithmetic of Active Management paper by Nobel Prize winner William F. Sharpe shows that for every dollar that outperforms the market benchmark, another dollar will underperform. It is a zero-sum game among all market participants, before costs.

The market benchmark (the weighted average of all securities in the market) represents the average of all investors in the market – before deducting costs.

In practice, however, all investing and investment funds incur costs (from trading and management), which means that the average fund underperforms the market benchmark, leaving a minority of funds able to outperform over a given period.

Both vanilla index and the median active funds underperform the market benchmark BUT vanilla index funds are more cost effective, so they consistently outperform the median fund. Non-vanilla index strategies (where the rules are actively determined) also offer outperformance potential, with the benefit of transparency and lower costs, making them an attractive alternative to both active and vanilla indexed strategies.

Consistently Outperforming the Market is Very Difficult

Active managers tactically take advantage of opportunities in the market to differentiate themselves. This means their value should, in theory, be highest when opportunities to differentiate are the strongest. Conversely, if all asset classes moved in perfect step, low-cost rules-based solutions would be expected to have the edge (as the ability to differentiate actively is nullified).

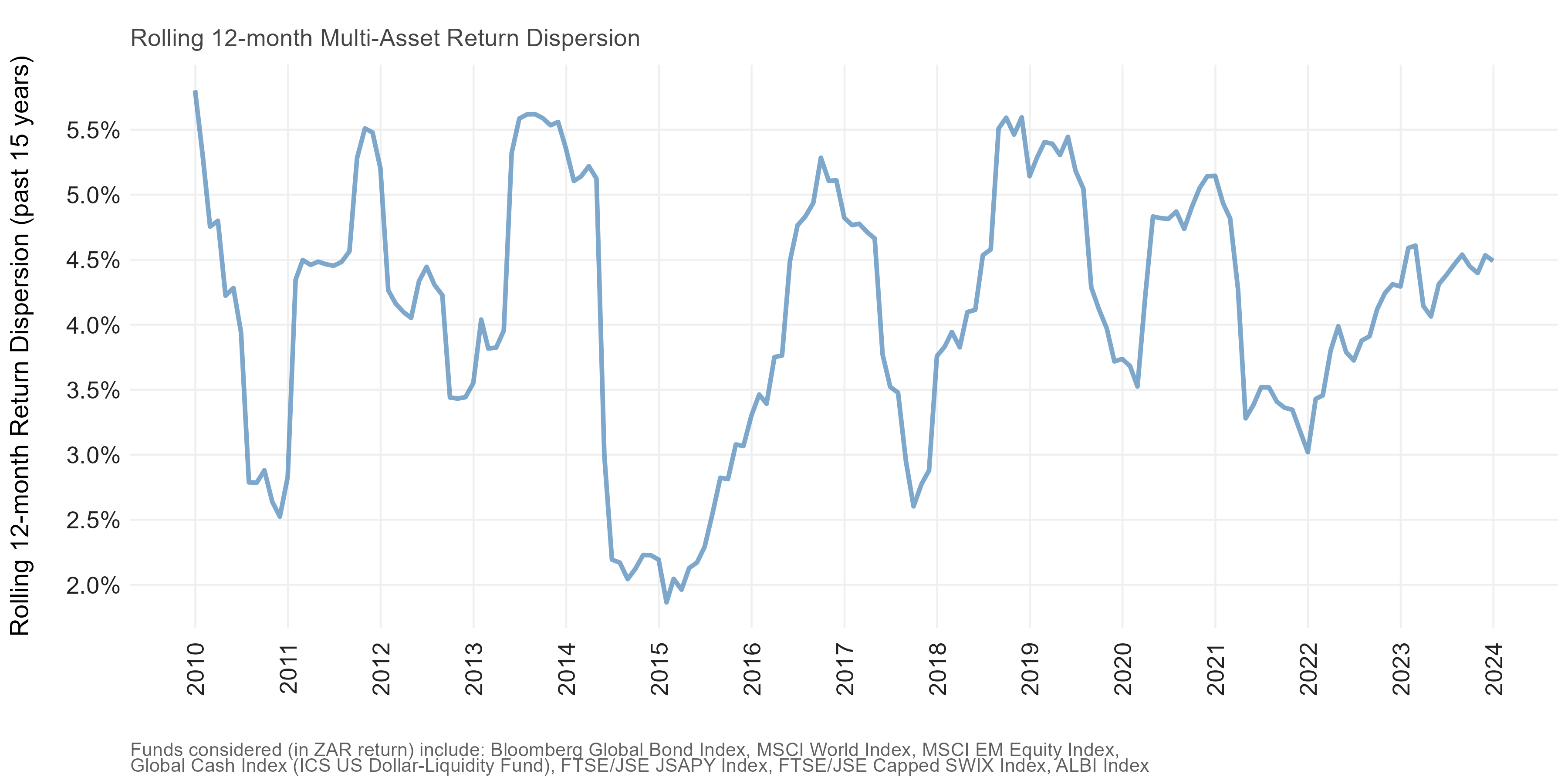

Williams says that, “in the balanced fund space, the ability to differentiate will arguably be the greatest, with managers able to actively decide how to allocate within and between asset classes. Yet historically, we’ve not seen evidence that active managed funds have been able to consistently harness high available opportunities to outperform rules-based funds. To show this, we proxy for alpha opportunity by measuring asset class dispersion, or periods where asset class return differences are the highest. This is calculated by squaring the return differences between asset class returns and summing it.

“We plot the return dispersion (or aggregate return dissimilarity) for several indices typically used by managers in the local balanced fund space, in rand. A higher dispersion value indicates that asset class returns deviate more from one another on aggregate – meaning active differentiation is more strongly rewarded.”

Source: Satrix & Bloomberg. January 2004 – December 2023

Williams says historically high alpha opportunities were available between 2020 and 2022. “This means, for a South African multi-asset manager, the period after 2020 coincided with a time when getting active calls right was the most profitable in our history. Despite this, the weighted average 12-month rolling returns of rules-based balanced funds have outperformed the median rolling returns of active managers 73% of the time, since 2020. This is also not a new phenomenon: over the 10 years since the Satrix Balanced Index Fund’s inception it has outperformed its active peers more than 90% of the time on a rolling three-year basis, clearly showing the value added from a long-term focussed, rules-based approach to investing over the medium term.

“Taken together, this suggests that either active managers are not sufficiently taking advantage of available opportunities to differentiate themselves using active tactical decisions to compensate for higher fees, or that making the correct tactical calls is exceedingly hard to do consistently. The real reason is probably a combination of both.”

Man and Machine

Active management has a very important price discovery role to play, and this is something that vanilla index solutions are ill-equipped to do. Active managers should be able to identify opportunities that may not be obvious from quantitative measures alone. This means that indexation can never fully replace active management, nor should it aspire to do so.

We believe that while the empirical case for indexation has been consistently strong, both locally and internationally, a more sensible approach for investors is to combine active and indexation strategies. Finding good managers with the ability to consistently add value is an important art, and one that might prove to become even more important in future. As artificial intelligence algorithms and access to information become mainstream, they will make prevailing prices even more accurately reflective of available information, eroding the easy opportunities available for active differentiation.

Active versus passive is a dead concept. A blend of man and machine, or active and indexation, should be the best strategy going forward. The numbers are too clear to ignore.

*Satrix is a division of Sanlam Investment Management.

Satrix Investments (Pty) Ltd is an approved FSP in terms of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision. Satrix Managers is a registered Manager in terms of the Collective Investment Schemes Control Act, 2002.

While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSPs, their shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaim all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.

Satrix Managers (RF) (Pty) Ltd (Satrix) is a registered and approved Manager in Collective Investment Schemes in Securities. Collective investment schemes are generally medium- to long-term investments. With Unit Trusts and ETFs the investor essentially owns a “proportionate share” (in proportion to the participatory interest held in the fund) of the underlying investments held by the fund. With Unit Trusts, the investor holds participatory units issued by the fund while in the case of an ETF, the participatory interest, while issued by the fund, comprises a listed security traded on the stock exchange. ETFs are index tracking funds, registered as a Collective Investment and can be traded by any stockbroker on the stock exchange or via Investment Plans and online trading platforms. ETFs may incur additional costs due to being listed on the JSE. Past performance is not necessarily a guide to future performance and the value of investments / units may go up or down. A schedule of fees and charges, and maximum commissions are available on the Minimum Disclosure Document or upon request from the Manager. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. Should the respective portfolio engage in scrip lending, the utility percentage and related counterparties can be viewed on the ETF Minimum Disclosure Document.

For more information, visit https://satrix.co.za/products |

Source: Nedgroup Investments Core Chartbook 2023 | Investment Company Institute

Source: Morningstar & Satrix, 31 December 2023

Source: Satrix, 31 December 2023