First, Let's Recap the Gifts of December

December 2023 brought respite from the worst year of loadshedding South Africans have experienced to date. Over the festive period, we enjoyed the longest period of uninterrupted power that many can remember in recent years. More good news: although the festive season is known for indulgence, investors enjoyed some positive returns for the month.

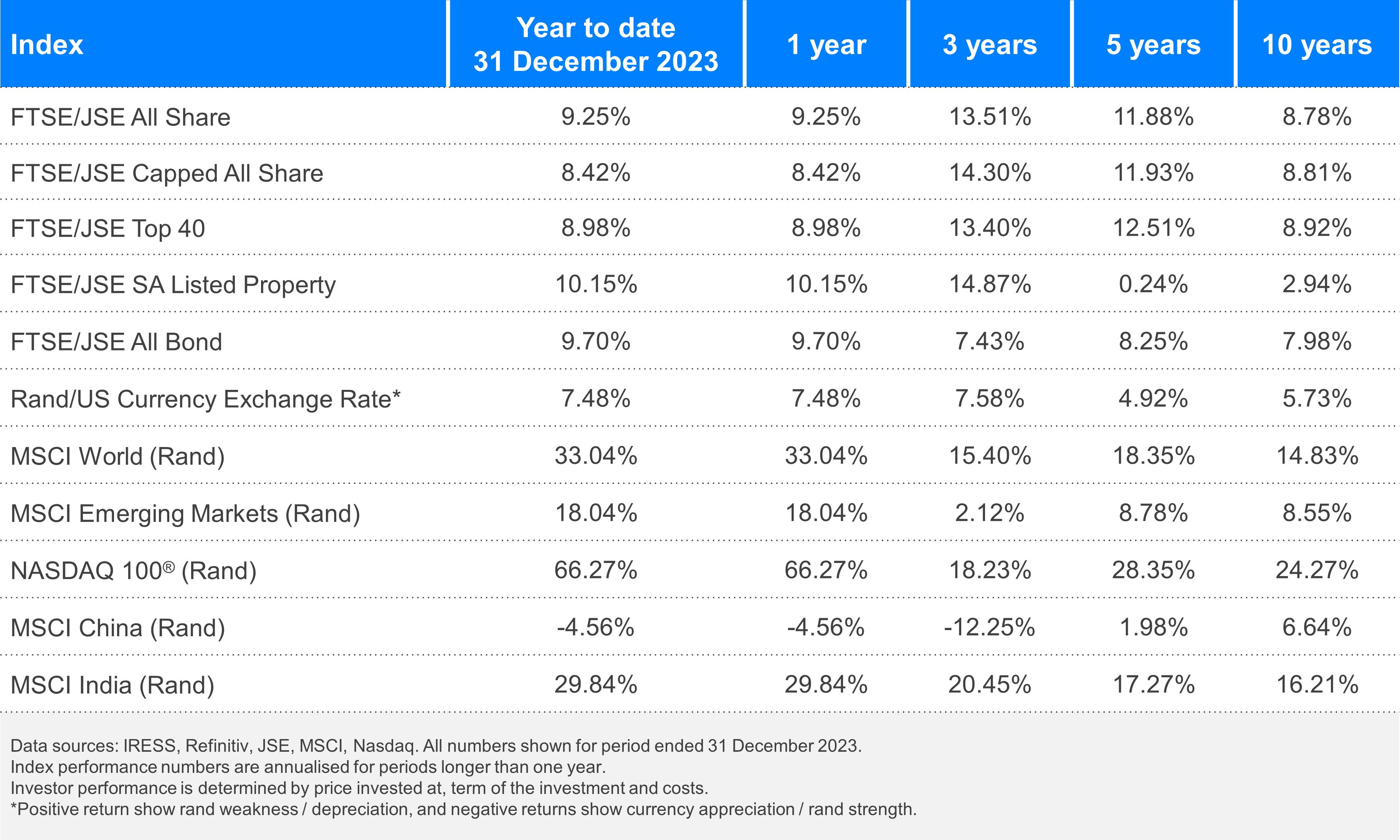

Locally, the biggest run came from the Property sector, gaining 9.9% for the month, followed by Financials, which were up 5.5%. Equity markets closed the year on a positive note, with the FTSE/JSE All Share Index up 2.0% in December. Local markets were also supported by a gain of 1.0% from Industrials, although premium stocks Naspers and Prosus closed the year on a bad note, with both stocks dropping 14.0% in a single day. This was a knock-on effect felt from new gaming restrictions being introduced in China. Gold always glitters, and the absolute winners on the JSE for the year were gold stocks, supported by the record-breaking bullion price reaching an all-time high. Platinum and the other diversified miners did create a slight drag on the sector, ending the month 0.2% down.

Unwrapping Some More

Fixed income did not hold back, with the All Bond Index up 1.5% in the last month of the year, while Inflation-linked indices were up 1.9%, and Global Bonds up 0.5%. The rand strengthened marginally during the month, moving from R18.95 to R18.29. The appreciation of the currency reduced some of the gains from offshore holdings priced in rand – but it remained a positive month for offshore indices generally. Finally, it was a great year for technology stocks, as the Nasdaq Index closed the year up a whopping 66%, with December returning 1.8%. The United States, United Kingdom, and Eurozone markets were all up 1% in December. India had a strong month, closing December up 4.3%, trumping China which was down 5.8%.

About That Refresh Button

With an extra day to create a positive impact in this leap year, the first quarter of the year presents a great opportunity for us to pause and hit the refresh button in all aspects, including savings and investments. The tricky part about putting money aside is the fact that you need funds to put aside and you then need to invest these, for the greatest return.

Here are a few tips to help start the year on a positive financial footing:

Build That Budget: Budgeting is one of the basic principles in finance, applicable to corporations and individuals. Tracking spending habits gives us an understanding of exactly where the money goes each month, thus giving us insight into what to cut back on and where to allocate more – preferably into savings. Food for thought: of the 37 Satrix JSE-listed Exchange Traded Funds (ETFs), 20 currently have an asking price equivalent to that of a large cappuccino (R40).

Consider Tax-Free Savings: Nobody likes to part with their hard-earned money or interest gained from saving. While gains on investments, dividend income, coupons, and interest often include a portion that goes to the tax man, a Tax-Free Savings Account (TFSA) gives investors full returns on their savings. TFSA’s have an annual deposit limit of R36 000 per investor and there are no age limits on investments, which means children can start making investments, too.

Save and Invest: You should save for unexpected expenses, holidays and gift-buying for withdrawal when needed in the short term. But investing is for the long term, for your future self, and the only way to make investing impactful is to keep your money invested for a long period. More time in the market means more opportunities to invest in assets which can attract higher returns over the long term. And yes, you should ideally do both.

Brush Up on Your Financial Literacy: Make sure your money is working for you. You may not be a finance guru, but you should be able to make well-informed decisions with your hard-earned cash and you should be able to understand if your investments are doing well. Markets can be complex and there is an ocean of products to choose from. Luckily, the information age means that reputable finance podcasts and blogs are in abundance, and financial data is also available online. Read all about it.

As We Move

The refresh button also allows us to make sure our plans for the future are on track. This is an opportunity to reflect and set new goals or polish existing ones. Check in on retirement annuities, credit scores, insurance payments and all those “adulting” matters that will keep the future looking bright if you make a small investment in time, today.

We are wishing you growth and prosperity in 2024!

Disclosure

Satrix Investments (Pty) Ltd is an approved FSP in term of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision. Satrix Managers is a registered Manager in terms of the Collective Investment Schemes Control Act, 2002.

While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSPs, their shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaims all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information. Full details and basis of the award is available from the Manager.