Satrix ETF or Satrix Unit Trust - what you should consider

Satrix offers both Exchange Traded Funds (ETFs) and Unit Trusts – here are some important considerations when deciding which one is right for you.

FIRST CHOOSE YOUR INDEX

Index investing is no longer just about tracking a popular market cap weighted index in order to realise inflation beating returns. The decision as to which index to track really is an important and active choice. In addition to traditional market cap weighted indices, any factor weighted index can also be tracked to realise a myriad of performance drivers in any market. Within each index segment, “traditional vanilla” or “smart beta”, lie a wide range of index choices, both locally and globally.

EXCHANGE TRADED FUND (ETF) or INDEX TRACKING UNIT TRUST (UT)?

Once you’ve made the index choice, you need to choose an index-tracking product which can deliver the performance of that index. Just as the list of available indices has expanded, so have the index tracking product options.

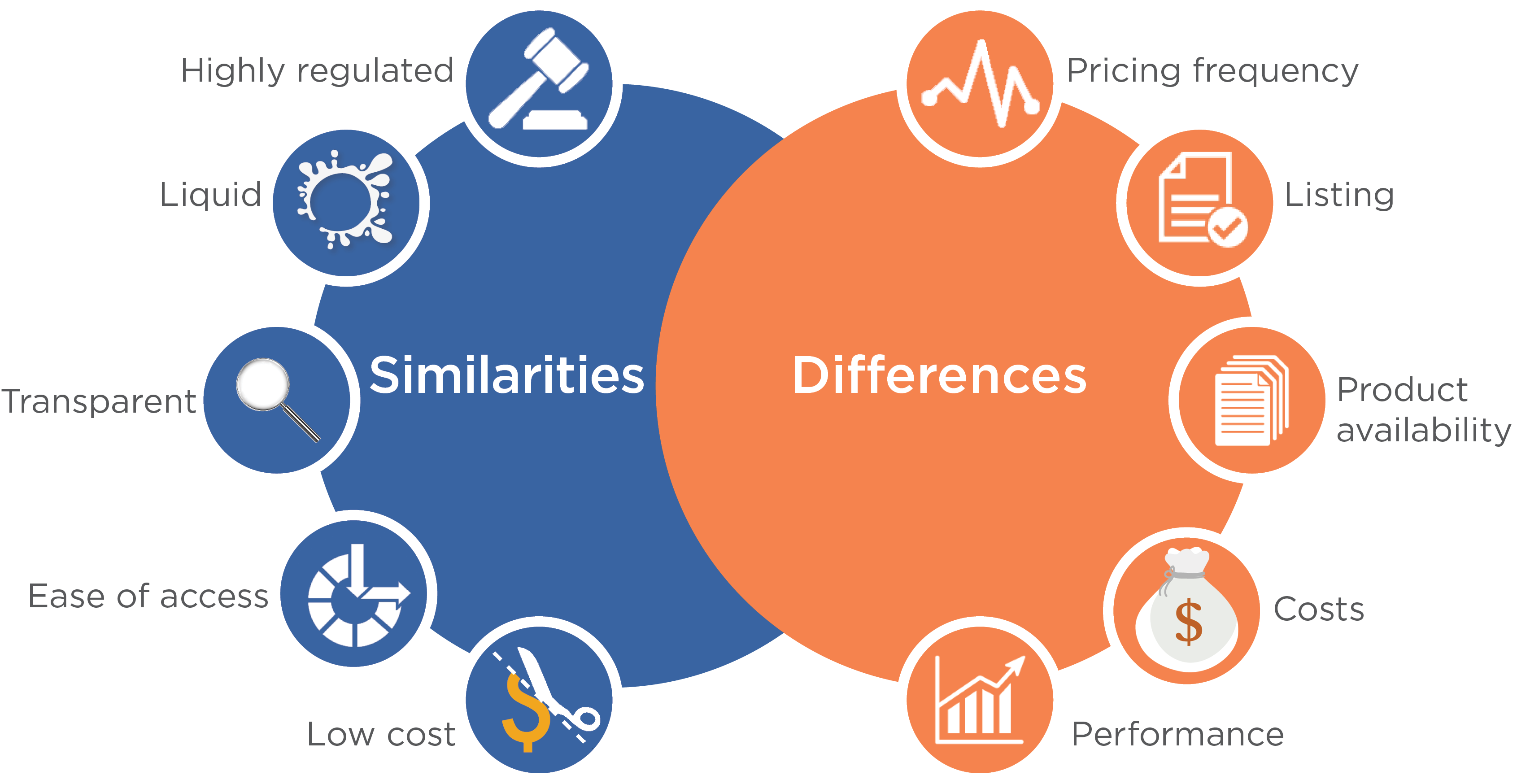

Which vehicle is right for you - ETF or UT? Here are some considerations:

WHERE THEY ARE THE SAME

In the case of both Unit Trusts and ETFs the investor essentially owns a proportionate share of the total underlying investments held by the fund. Both offer investors access to the performance of an underlying pool of assets via a single transaction. With Unit Trusts, the investor holds participatory units issued by the fund while in the case of an ETF, the investor holds a security or share listed and traded on a stock exchange. When an ETF and UT track the same index (take the FTSE/JSE Top 40 as example), there is no difference in the underlying portfolio. Both will fully replicate the index by holding all the Top 40 constituents in exactly the same weights as the index. Both vehicles are governed by the Collective Investments Scheme Control Act (CISCA), are monitored by independent trustees and are highly regulated by the Financial Sector Conduct Authority (FSCA).

Both are transparent. Both are liquid.

Index-tracking investments, whether via an ETF or UT, are low cost investment options.

LISTING AND PRICING FREQUENCY

The ETF, as the name implies, is listed and traded on the stock exchange like any other company share. It is therefore subject to the JSE listing requirements. An ETF is priced continuously throughout the trading day, while the UT is priced once a day and traded via the Unit Trust Management Company (Manco). If you are a long term investor this pricing frequency should not matter to you. When investing in an ETF or UT on our SatrixNOW.co.za online platform you will notice that the processes differ - for example the continuous pricing of the ETF means you will receive immediate trade confirmation via e-mail, whereas the UT trade confirmation can be expected the next trading day and is dependent on cut-off times.

The ETF, by virtue of its listing, is subject to the JSE settlement cycle for equities, which is currently 3 trading days. When selling an ETF investment your proceeds will therefore be received a few days later than when selling a UT. Note this is no reflection on the liquidity of the ETF investment.

TRANSPARENCY

Index-tracking funds are very transparent - you know exactly what you are invested in. An ETF must publish its holdings daily. The UT does not have this requirement as unit trust regulation only specifies a quarterly reveal of holdings. This does not mean the transparency of the UT is in question. As unit trusts have traditionally been actively managed funds, the quarterly publication of holdings is reasonable as an active manager would naturally not want to reveal their positions daily. As mentioned, the UT reflects the index and since index data is continuously available, effectively so is the UT data.

COSTS

The MDD (Minimum Disclosure Document) of any ETF or UT will show the management fee and TER (Total Expense Ratio). In addition, access costs will make a difference to the total cost of your investment. To make an informed decision on costs, review the cost of any platform, LISP, online trading facility or stockbroking account and add this to the product cost. In addition, if a financial adviser is used, the cost of this advice must also be considered. Our SatrixNOW platform offers both ETFs and UTs with no minimum investment amount. Remember that since the ETF is a listed security, a brokerage cost will be incurred when trading the ETF, but this is not applicable to the UT.

All providers are required to make an EAC (Effective Annual Cost) calculation available for their products. Use this calculator to help you make decisions on both products and the platforms where you can access them.

PRODUCT AVAILABILITY

The index-tracking product you require may not be available in both ETF and UT format. For example Satrix currently offers sector trackers (Resi 10, Fini 15, Indi 25) in ETF format only. Satrix Alsi40, Dividend Plus and Rafi 40 are available in both ETF and UT format, while Money Market and Balanced tracker funds are available as Satrix UTs. Globally we offer 3 ETFs (MSCI World, MSCI Emerging Markets and S&P500) and 1 Unit Trust (MSCI World). Visit Satrix products for details. The Satrix Access Range features our flagship ETFs and UTs, simply and at low cost via our online platform SatrixNOW.co.za

PERFORMANCE

The performance of an ETF and UT tracking the same index and charging the same fee should be similar. Some differences may occur mainly due to cash flows and fund size. UT cash flows take place in the fund, causing additional trading & custodian costs which can affect performance.

Cash flows within the ETF are managed by the buying and selling of ETF securities in the secondary market, so here an additional bid-offer spread must be considered.

INDIVIDUAL CHOICE

Whether you choose an ETF or UT as your index tracking investment vehicle should depend on the reasons outlined above. Your individual circumstance will dictate the best route for your investment needs and the choice may simply be a matter of personal preference. Either way, you will realise your goal of achieving returns as close as possible to that of your chosen index.