Introducing the new Satrix JSE Global Equity exchange traded fund (ETF), which tracks the performance of the FTSE/JSE Global Investor Index, which is comprised of local equities with a stronger global flavour. The index uses global free floats in weighting constituent companies, thereby offering a rand hedge alternative to local equity indices with a higher proportion of earnings from offshore.

Satrix JSE Global Equity ETF

Over the past few years, local equity indices using the ALSI methodology have seen significantly reduced exposure to inward listed multi-national companies, such as BHP Group Limited (BHP), Compagnie Financière Richemont (CRF), Glencore PLC (GLN), Naspers (NPN), Prosus (PRX), and Anheuser-Busch INBev (ANH) (SAB), where the index rules meant corporate actions and restructuring efforts resulted in their floats being considered for local index consideration, substantially reduced.

This has led to the broad local equity indices organically becoming more exposed to local macroeconomic idiosyncrasies (often referred to as SA Inc. factors). For many clients that use or track local equity indices, this has resulted in a more concentrated risk profile and a higher exposure to rand weakness.

The FTSE/JSE Global Investor Index upweights global companies by considering the global free float for index weighting and inclusion purposes. This means the FTSE/JSE Global Investor Index, by construction, offers investors a stronger rand hedge and a larger proportion of earnings from offshore.

Investors will now be able to blend the Satrix Global Equity ETF with existing equity indices in order to gain index exposure that more closely resembles the ALSI methodology used in the past (where global free floats were used for “Grandfathered” companies). [1]

[1] “Grandfathered” companies were originally local companies that moved their primary listing offshore prior to 25 October 2011. ALSI indices used the global free float for these companies (e.g., AGL, BHG, CFR) while considering the local float for all the other constituents. The SWIX methodology only considered the free float registered on STRATE.

By holding the Satrix Global Equity ETF, investors gain higher offshore earnings exposure and improved rand hedging by design. This can act as a useful ballast to other local equity indices, which down-weight the dual-listed companies.

This is particularly relevant as the JSE will be harmonising the local benchmark indices (ALSI and SWIX methodologies) in March 2024. The local equity benchmarks will then down-weight the inward-listed global companies by considering only their local free float for inclusion and weighting (i.e., harmonise to the SWIX methodology).

This local ETF will list on the Johannesburg Stock Exchange (JSE) and investors will access it in South African rand.

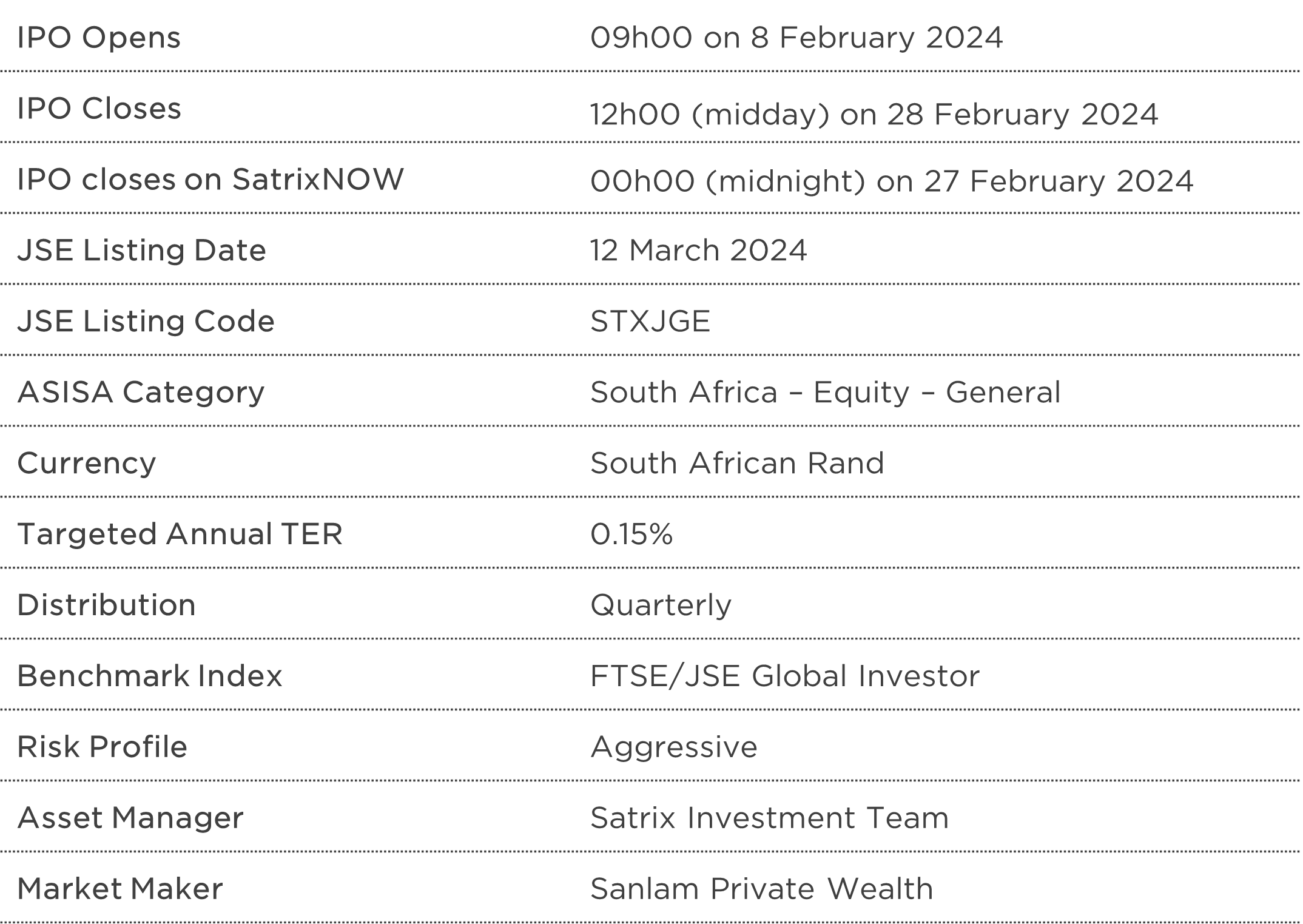

Key Dates

About the FTSE/JSE Global Investor Index

The FTSE/JSE Global Investor Index offers exposure to the 50 largest locally listed companies. The index is constructed by using each company’s global free float, as opposed to what is listed on the local STRATE register. This makes it a local index, with a strong global flavour. The index back-test shows that the strategy tends to outperform the local indices during periods where the rand weakens.

Who should invest in this ETF?

This ETF is suitable for investors with a longer-term investment horizon and who are specifically looking for local equity exposure, but with a higher rand hedge component and greater exposure to earnings from offshore. Investors should expect and be able to withstand equity-like volatility.

How to Invest

Existing investor: You can access the Satrix JSE Global Equity ETF via SatrixNOW, which requires no minimum investment amount.

New investor: If you don’t yet have a SatrixNOW

It will also be available via other investment platforms and personal stockbroking accounts.

Download the IPO Information Sheet.

Disclosure

Satrix Investments (Pty) Ltd is an approved financial service provider in terms of the Financial Advisory and Intermediary Services Act, No 37 of 2002 (“FAIS”). The information above does not constitute financial advice in terms of FAIS. Consult your financial adviser before making an investment decision. While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSP, its shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaim all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.

Satrix Managers (RF) (Pty) Ltd (Satrix) is a registered and approved Manager in Collective Investment Schemes in Securities. Collective investment schemes are generally medium- to long-term investments. With Unit Trusts and ETFs, the investor essentially owns a “proportionate share” (in proportion to the participatory interest held in the fund) of the underlying investments held by the fund. With Unit Trusts, the investor holds participatory units issued by the fund while in the case of an ETF, the participatory interest, while issued by the fund, comprises a listed security traded on the stock exchange. ETFs are index tracking funds, registered as a Collective Investment and can be traded by any stockbroker on the stock exchange or via Investment Plans and online trading platforms. ETFs may incur additional costs due to being listed on the JSE. Past performance is not necessarily a guide to future performance and the value of investments / units may go up or down. A schedule of fees and charges, and maximum commissions are available on the Minimum Disclosure Document or upon request from the Manager. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. Should the respective portfolio engage in scrip lending, the utility percentage and related counterparties can be viewed on the ETF Minimum Disclosure Document.

For more information, visit https://satrix.co.za/products