In most countries, a primary function of the central bank is to implement monetary policies that maintain price stability, keeping inflation in check. Central banks, like the South African Reserve Bank (SARB), use interest rates to do this. Other central banks, like the Federal Reserve Bank (US Fed), did the same and that has helped in cooling down inflation, which has since made them pause, and now considering cutting, rates.

South Africans may remember May 2020 when the inflation rate bottomed at 2%, moving outside the SARB’s target of between 3% and 6%. This triggered a sequence of interest rate cuts (some issued at special Monetary Policy Committee (MPC) meetings) from 6.5% at the beginning of 2020, to 3.5% by July of that year. Fast forward to July 2022 when inflation peaked at 7.8% breaching the upper limit, at which point the MPC had already started hiking interest rates. SARB came close to realising a comfortable midpoint of their inflation target range (4.5%) in July 2023 when inflation hit 4.7%.

The Reality Faced by Investors

Despite inflation cooling we are still paying more for things given inflation is high. The country now faces a 5.3% inflation rate and a repeatedly delayed interest rate cut, thus keeping interest rates higher for longer than expected. As a result, consumers and big corporations face high borrowing costs, which means both are servicing high interest debt.

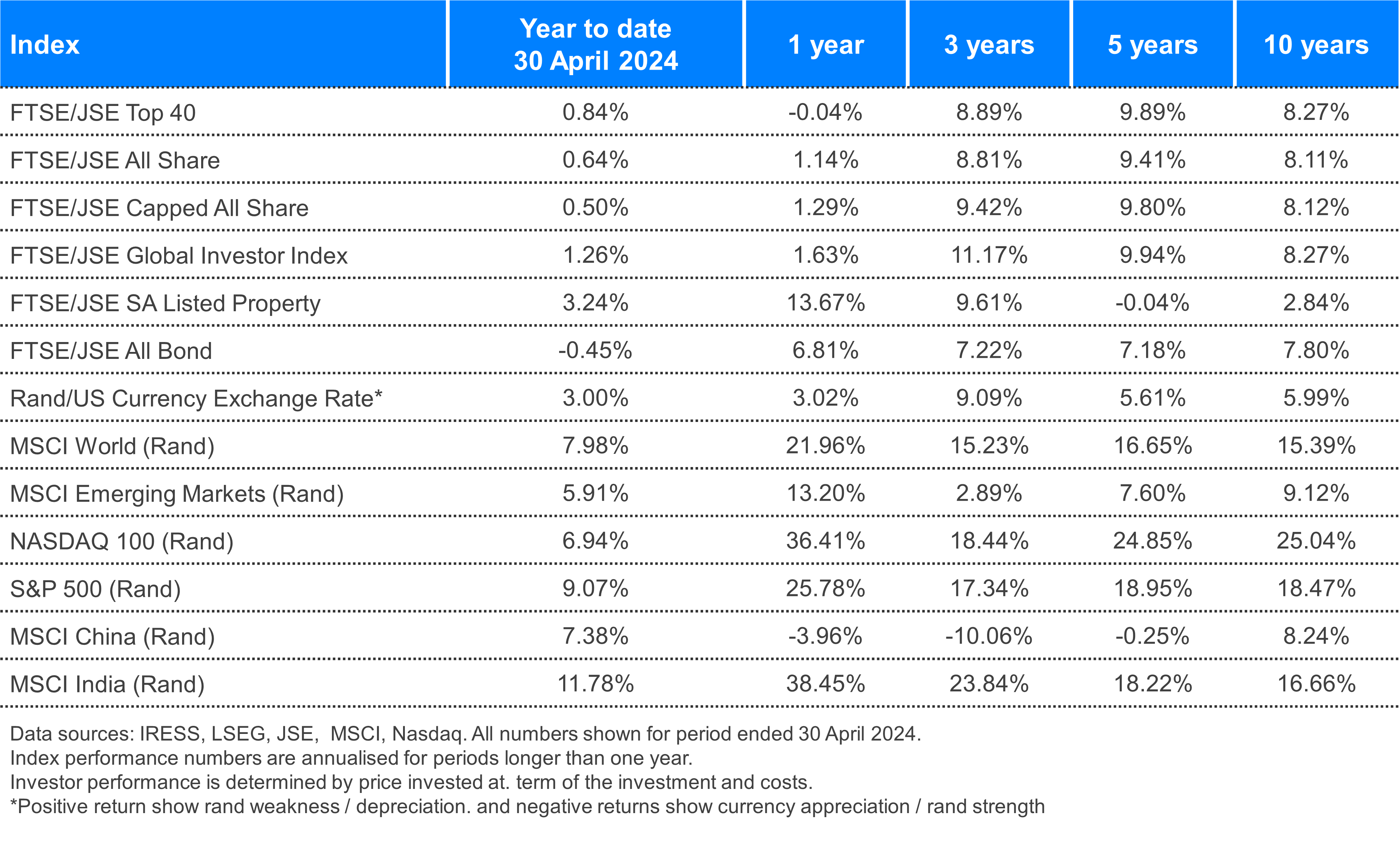

Investors should thus be strategic about the asset classes they choose while keeping up with high inflation. The reality is that over the last three years, investors had to keep up with an annual inflation rate of 6.1%, and those exposed to an asset class that had returns below that, in the same period, faced erosion in growth. With the total returns quoted in rands, the chart below shows which asset types kept up with, or did better than, inflation over the last three years, and which ones did not.

Figure 1: Satrix, JSE – 30 April 2024

The chart shows global equities having the highest return, with the NASDAQ index returning almost 12% per annum above inflation, but investors in this asset class would have experienced high volatility over those three years. Currency weakness against the dollar also favoured offshore assets. Local banks also took advantage of the high interest rate environment by lending at higher rates, while local listed property stocks also had strong returns. The high interest rate environment also shows that Cash kept up with inflation over this period, while an Emerging Markets (largely dragged by China) struggled as local Resources proved to be the worst performers against inflation.

A More Short-Term Look

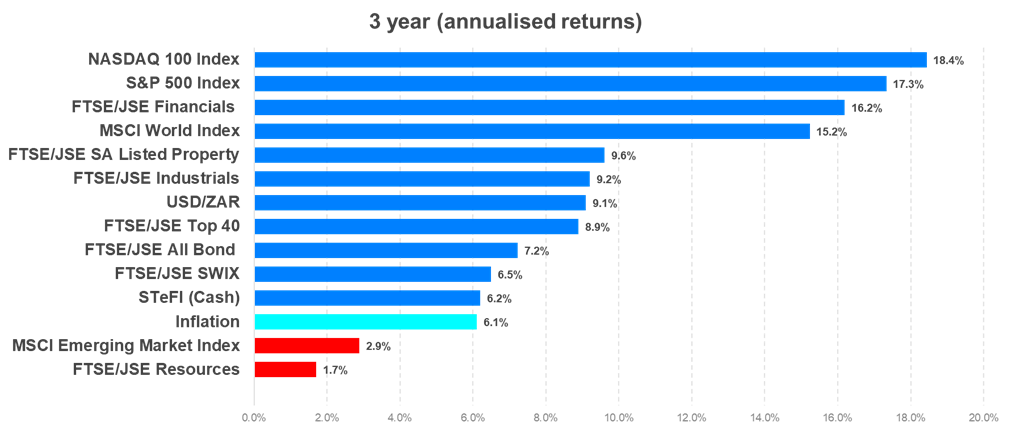

Local markets had a strong month again, with the FTSE/JSE All Share Index up 3.0% in April, putting 2024 in positive territory in equity returns (up 0.6% YTD). At the back of this recovery, the Resource Index was still the strongest sector in local markets, up 7.1% for the month, while Industrials were up 1.3% and Financials were up 2.7%. After having a strong start to the year, listed property slowed again in April with the FTSE/JSE SA Listed Property Index (SAPY) down 0.6%. The All Bond Index (ALBI) was up 1.4% for the month and the STEFI was up 0.7%.

The rand strengthened against the dollar, closing the month at R18.83, a 0.5% appreciation from the start of the month.