What it actually means when you INVEST GLOBALLY, LOCALLY

Have you ever wondered why the performance of your global ETF sometimes looks like it is moving in the same direction as the global index it tracks and sometimes it just doesn’t?

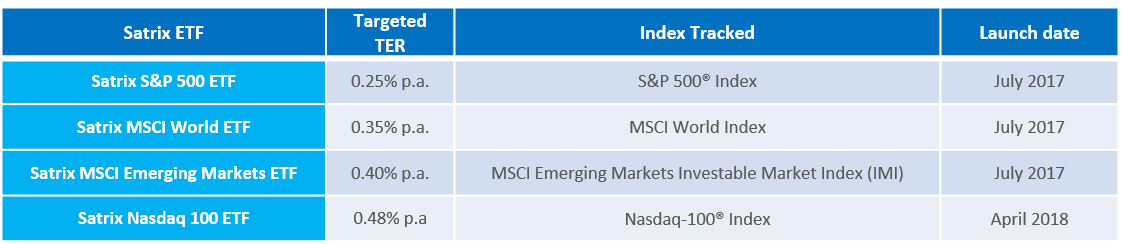

Satrix offers 4 global ETFs which track global indices – Satrix MSCI World, Satrix S&P 500, Satrix MSCI Emerging Markets and, most recently, the Satrix Nasdaq 100 ETF. These ETFs are listed locally on the Johannesburg Stock Exchange (JSE) and offer investors Rand exposure to offshore markets.

Let’s use the Satrix S&P 500 ETF as an example and look at how this works in more detail.

If an investor holds the Satrix S&P 500 ETF, they use South African Rand to purchase this ETF and they earn US dollar returns.

There are however two primary drivers of the performance of this ETF:

- the performance of the S&P 500 Index in US dollars, and

- the performance of the Rand versus the US dollar

When investing offshore, two levers need to work in your favour:

- the underlying asset needs to appreciate (in this case the S&P 500), and

- the currency you’re investing in should strengthen (or put differently, the rand should weaken).

If the rand strengthens, this will offset any growth achieved in the S&P 500.

Let’s see how this works with a real-world example.

Assume you wanted to buy yourself a gadget (e.g. a high-tech drone) which was not readily available in South Africa. You would probably use your credit card and purchase this through a retailer in the USA.

Suppose the rand/dollar exchange rate was R10/$1 and the drone was priced at $1,000. Your purchase would cost you R10,000.

Assume a year later, you wanted to sell your drone. The price for it in the USA has gone up to $1,100, but the rand has strengthened to R9/$1.

In rand terms, it is now only worth R9,900, even though in dollar terms it has increased in value to $1,100.

The weakening of the dollar (strengthening of the rand) would have devalued your purchase, even though it is worth more in dollar terms. You probably wouldn’t find many buyers at R11,000 ($1,100 x R10/$1), as they would be able to purchase it for R9,900 at the current exchange rate, directly from the retailer.

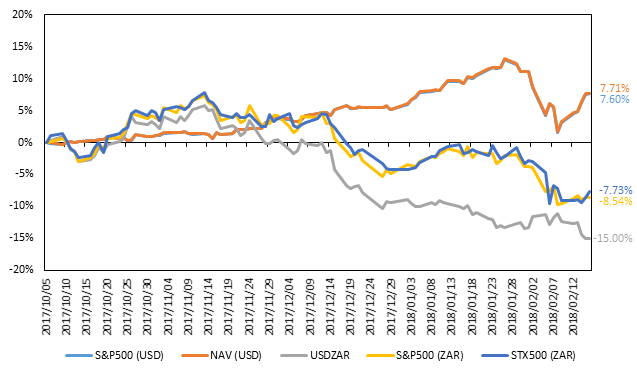

The same approach is used when valuing ETFs, except this occurs on a real-time basis throughout the JSE’s trading hours. To illustrate the performance of the Satrix S&P 500 ETF we have plotted the following chart.

Each line represents the cumulative compounded performance starting at the close of Thursday, 5 Oct 2017 through to the close of Friday, 16 Feb 2018. Please note, individual investors’ performance may differ due to the price at which they transacted as well as transaction costs and taxes. A description of each line follows:

S&P 500 (USD): This is the performance of the S&P 500 Total Return Index in US dollars, and is the performance we want from our underlying investment in US dollar. It returned 7.60% over this period.

NAV (USD): This is the performance of the underlying fund tracking the S&P 500 Index, which is virtually indistinguishable from the performance of the index. In fact it has slightly outperformed the index over this period, and returned 7.71%.

USD/ZAR: This is the performance of the dollar versus the rand. On 5 Oct 2017 it closed at R13.67/$1 and weakened to R11.62/$1 (Source: IRESS). The dollar weakened by 15% relative to the rand over this period.

S&P 500 (ZAR): This is the performance of the S&P 500 Total Return Index in South African rands. This is what our investment is actually tracking. It is calculated by multiplying the S&P 500 Index level by the exchange rate, as we did in our example with the drone above. Over the period it returned -8.54%, because the weakening dollar relative to the rand, offset the growth in the S&P 500 in Dollar terms.

STX500 (ZAR): This is the performance of the Satrix S&P 500 ETF held by South African investors using the closing prices between 5 Oct 2017 and 16 Feb 2018. Over this period, it returned -7.73% and has tracked the S&P 500 (ZAR) quite closely delivering outperformance of 0.81%. Out of interest, on 12 Dec 2017, the currency was at roughly the same level as it was on 5 Oct 2017, and therefore the performance of the Satrix S&P 500 ETF was closely aligned with the S&P 500 (USD), as there was no currency impact. You’ll also notice that the dollar was stronger in November, which resulted in Satrix S&P 500 ETF amplifying the modest gains of the S&P 500 (USD) at that point.

Investing offshore is a great way to diversify your investments, but it does introduce currency risk, particularly if the currency you have invested in gets weaker relative to the rand, or the rand strengthens. However, investing for the long-term and having a disciplined approach to saving each month are timeless strategies to grow wealth.